Vehicle Appraisal Reports

Free Estimate · Diminished Value and Total Loss Appraisal Reports

Get fast, accurate, and court-ready Diminished Value and Fair Market Value (total loss) reports.

No guesswork, No delays. Trusted by insurers and legal professionals.

Free Estimate - No credit card required.

Recover What Insurance Owes You After an Accident

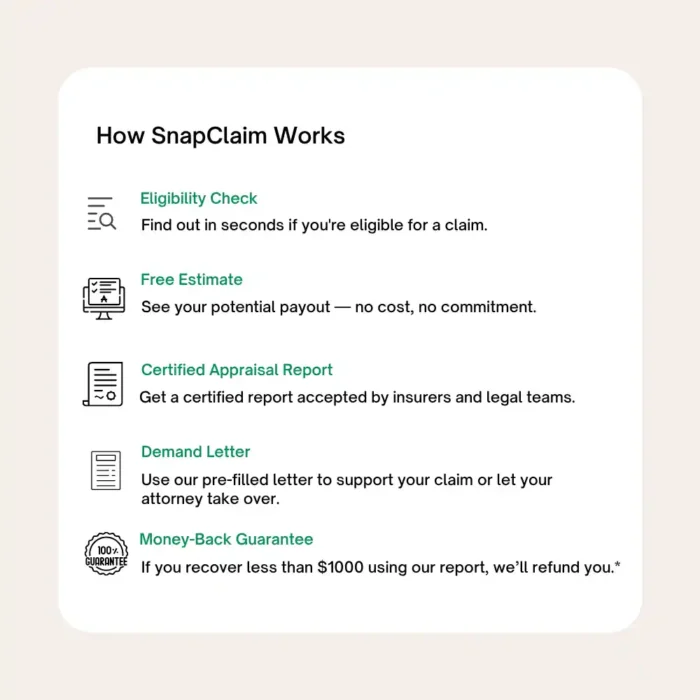

SnapClaim helps you recover your car’s lost value after an accident with diminished value claims and total loss appraisal reports. We provide a free diminished value estimate, a fully certified appraisal report, and a ready-to-send demand letter — all delivered within minutes. No guesswork, no waiting, and trusted by drivers, attorneys, and insurance professionals nationwide.

Find out if you qualify today :

“I had no idea my car had lost that much value after the crash. SnapClaim gave me everything I needed to file the diminished value claim — I got the report in less than an hour.”

Mark

Vehicle Owner, Colorado

Your trusted partner in car accident claims

From accurate appraisals to faster settlements, we give every stakeholder

the tools to simplify, support, and scale the entire claim journey.

Streamline Your Car Accident Case Preparation

SnapClaim helps law firms handle diminished value claims and total loss insurance cases with ease. Our appraisal reports deliver consistent formatting, reliable market data, and fast turnaround times — ensuring you have the documentation you need to maximize settlements and support your clients. Focus on winning cases, not chasing appraisals.

Certified Diminished Value & Total Loss Appraisal Reports

Get your certified diminished value appraisal or total loss report. SnapClaim combines appraiser expertise with real market data to deliver fast, accurate, and court-ready documentation. From free estimates and demand letters to full support through settlement negotiations, we make sure you recover the true value of your vehicle — without delays.

Scale Your Auto Appraisal Business

Generate diminished value or total loss appraisals in minutes, backed by real-time market data and AI accuracy. Automate report formatting, minimize bias, and instantly scale your workload with tools that support documentation, pricing, and workflows.

Turn Repairs into Extra Revenue Opportunities

Don’t just fix cars — help customers recover their diminished value with professional appraisal reports. SnapClaim makes it fast, accurate, and profitable for your shop while earning long-term trust from clients.

For Personal Injury Attorneys — See It in Action

See how SnapClaim can support your practice and clients.

See what ourclientsare sharing about us!

“I didn’t know about diminished value until I found SnapClaim. Their report was done in minutes, and the support team explained everything clearly. I used the letter they provided and ended up with an extra $3,200. Super easy.”

“SnapClaim helped me file a diminished value claim after repairs. The process was smooth, fast, and I received more money than expected. Their team handled everything so I could focus on getting my car and life back to normal.”

“I uploaded my repair estimate and got a professional report the same day. SnapClaim made everything so simple. Their platform saved me hours of back-and-forth with insurance and got me a solid payout”

“After my car was totaled, SnapClaim gave me a fair market value report that clearly beat the insurance offer. I submitted it with my claim and they increased the payout. The process was fast, fair, and worth every penny."

“SnapClaim made a huge difference for me. I had no clue how to value my vehicle post-accident. Their diminished value report was detailed, with comps and expert review. I sent it in and got a great settlement in less than a week. Truly amazing.”

“SnapClaim is a game-changer. I used their fair market value report after a total loss, and it helped me negotiate a much better offer. The design, speed, and clarity of the report made a real difference with my adjuster..”

Frequently asked questions:

- What is a Diminished Value (DV) claim?

Diminished Value is the loss in market value a vehicle suffers after an accident, even after repairs. If your car has been in an accident caused by someone else, you may be entitled to compensation for this loss.

- What is a Fair Market Value / Total Loss Value report?

A Fair Market Value report estimates your vehicle’s current value based on verified market data. It’s commonly used for insurance negotiations, resale, legal cases, and total loss disputes.

- How do I check if I’m eligible for a claim?

Simply click the Check My Eligibility button on our homepage. Answer a few quick questions, and we’ll instantly tell you if you qualify for a Diminished Value or Total Loss claim.

- What do I need to get started?

You’ll need your VIN number, mileage, repair document (if applicable), and your contact information. We’ll guide you step by step through the process. Get your free estimate here

- How do I order a Diminished Value appraisal?

Go to the Free Diminished Value Estimate page, enter your vehicle and accident details, and if you choose to proceed, we’ll deliver your certified DV appraisal report — accepted by insurers and legal professionals — within minutes.

- How do I order a Fair Market Value/Total Loss claim appraisal?

Go to the Free Fair Market Value Estimate page, provide your vehicle’s details, and we’ll calculate its pre-accident market value. If you choose to proceed, we’ll send you a certified Total Loss appraisal report you can use with your insurer.

- What is your refund policy?

If you recover less than $1000 from your claim using our report, we offer a full refund of the report cost—no questions asked. Terms and conditions apply. You can read more here Money Guarantee Policy .

- I’m a personal injury lawyer or appraiser. Do you offer partnership opportunities?

Yes! We work with attorneys, appraisers, and body shops nationwide. Partners receive access to discounted pricing, priority support, and white-labeled reports. Contact our sales team at [email protected] to learn more about how we can support your clients and streamline your valuation needs.

Latest articles

How to Get a Diminished Value Claim After an Accident |

- •

- September 29, 2025

Claim Your Car Accident Diminished Value

- •

- September 29, 2025

Diminished Value & Total Loss Appraisal Reports

in minutes

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.