Has your insurance company declared your car a total loss and sent you a CCC ONE Market Valuation Report? Before you accept their settlement offer, it’s crucial to understand that this document single-handedly determines their payout amount. This guide will show you how to read it, find common errors, and ensure you get the fair compensation you deserve.

Why This Report Controls Your Insurance Payout

When your car is totaled, insurers don’t guess its value. Nearly every major carrier uses third-party software from CCC Intelligent Solutions to generate an automated valuation. This standardizes their claims process and provides what appears to be objective data to support their settlement offer.

The Insurer's Standard Tool

Think of the CCC ONE report as the insurance adjuster's starting point in a negotiation. It’s designed to look official, filled with charts, "comparable" vehicles, and a series of adjustments. This is intentional. The goal is to present a number that seems so thoroughly researched that you won't question it. The efficiency of this system is powered by automated claims processing, making it the go-to tool for adjusters everywhere.

However, it's essential to review it with a critical eye. While the report is data-driven, it often contains errors, omissions, and biased adjustments that can shortchange you by thousands. For a deeper look into this, check out SnapClaim's complete breakdown of the CCC ONE Market Valuation Report.

Common problems we see every day include:

- Incorrect Vehicle Details: The report might miss your premium sound system, sunroof, or upgraded trim package, which drastically lowers the vehicle's base value.

- Unfair Condition Adjustments: We often see deductions for normal, age-appropriate wear and tear—things that don't truly impact a car's fair market value.

- Poorly Chosen Comparables: Insurers might use cars from different states (like the "Salt Belt," where rust is common) or vehicles with fewer features to drag the average price down.

Understanding what’s inside your CCC report is the first and most important step toward securing a fair settlement. This guide will walk you through how to read it, spot the red flags, and build your case.

How Your CCC ONE Market Valuation Report Is Calculated

Ever wonder how an insurance company determines your car's value after an accident? They rely on a powerful software system, most often CCC ONE, to generate a CCC ONE Market Valuation Report.

This report functions like a real estate appraisal but for your vehicle. The system is designed to be fast and standardized, searching massive databases of vehicles for sale to find "comps"—cars that supposedly match yours. The goal is to establish a baseline value based on what similar vehicles are selling for in your local market.

On the surface, this sounds fair. But the details are where the process can start to work against you.

Finding "Comparable" Vehicles

The first step for the CCC ONE software is to identify a handful of "comparable" vehicles. It looks for cars with the same make, model, year, and similar mileage.

This is the first area where inaccuracies can occur. The adjuster can influence which comps are selected, and it’s easy for bias to affect the outcome. The system might pull vehicles from dealer lots that are in worse condition, have fewer options, or are priced aggressively to sell quickly. These less-than-ideal examples then become the foundation for valuing your well-maintained car.

The Problem with "Adjustments"

Once the software has its list of comps, it moves to the most critical—and often most subjective—part of the process: the adjustments.

This is where the software assesses your vehicle's condition against the comps and applies a series of positive or negative dollar values. For example, if your car has lower mileage than a comparable vehicle, you might receive a small credit.

More often, however, these adjustments are used to reduce your car's value. The system is programmed to find flaws and will make deductions for things like:

- Minor wear and tear: Normal scratches, small dings, or interior scuffs that any car of its age would have.

- Tire tread depth: Your tires could be perfectly safe, but if they aren't brand new, the system will likely deduct value.

- Previous repairs: Any sign of past bodywork, even if expertly repaired, can trigger a negative adjustment.

Each small deduction adds up, turning what seemed like a reasonable starting value into a lowball insurance total loss payout.

The economic scale of these automated systems is massive. While the auto market is huge, consider that the U.S. stock market capitalization soared to $67.8 trillion by late 2025—a figure that nearly tripled in just over 12 years. You can read more about these major market statistics on BestBrokers.com. In a world of such big numbers, automated, adjustment-heavy systems are how insurers shave off small amounts from millions of claims, saving them a fortune at your expense.

A Step-by-Step Guide to Reading Your Report

Opening a CCC ONE Market Valuation Report can feel overwhelming. It's filled with technical jargon, confusing charts, and numbers that seem designed to be confusing. But once you know what to look for, it becomes much easier to spot the convenient "mistakes" that can lower your settlement.

This section will serve as your guided tour. We'll break the report down into its three main parts: the Vehicle Information Summary, the Comparable Vehicles List, and the Adjustments Breakdown.

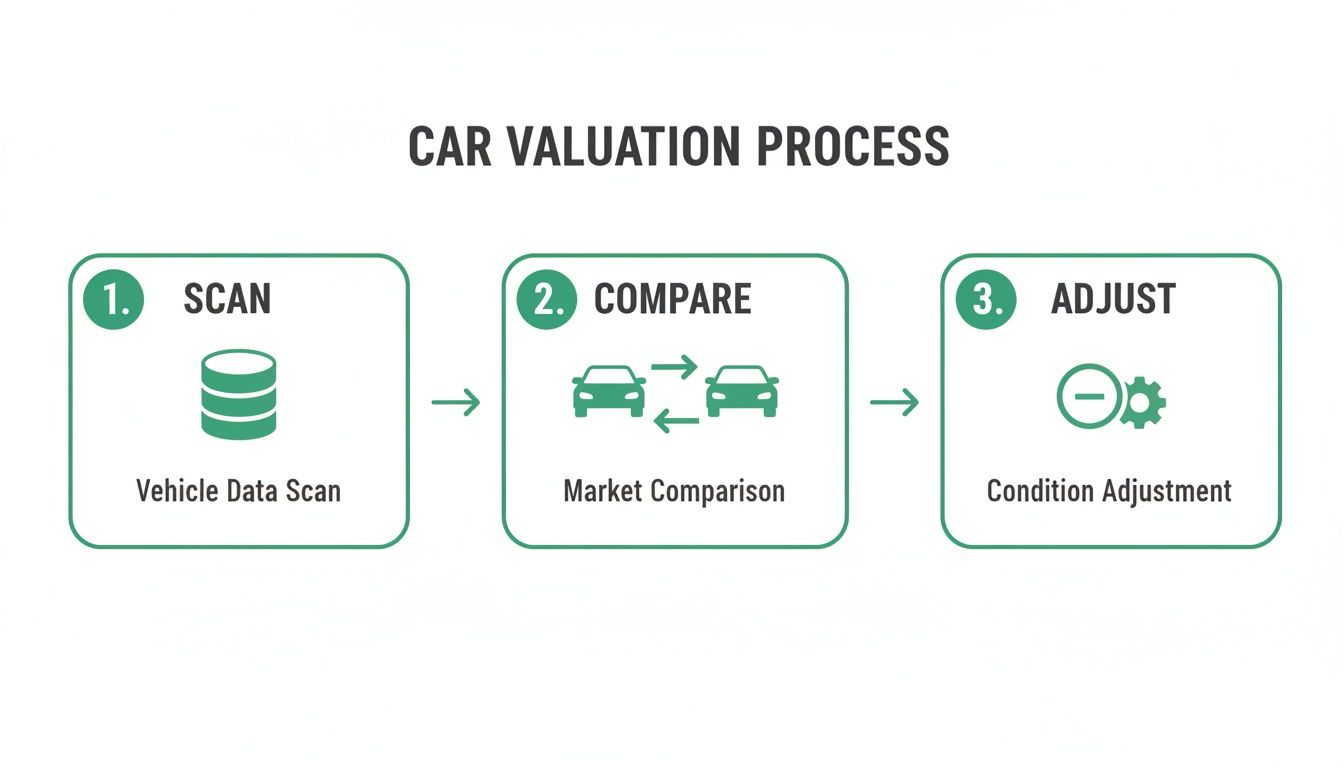

This graphic shows the basic process CCC ONE software follows: scan a database, compare vehicles, and then apply adjustments.

The catch is that every step in that process is an opportunity for errors and subjective decisions that can seriously lower your final payout.

Part 1: The Vehicle Information Summary

This is the foundation of the entire report. This section lists all the key details about your specific vehicle—the make, model, year, mileage, and all its optional features. If this section is wrong, the final value will be inaccurate.

- Check Your Trim Level: Is your car listed as a base model when you paid extra for a premium or sport trim? This is one of the most common and costly mistakes.

- Verify Optional Packages: Ensure every factory-installed option is listed, including a sunroof, premium sound system, navigation, or advanced safety features. Each one adds value.

- Confirm Vehicle Condition: The report will assign a condition rating to your vehicle (e.g., "Good" or "Fair"). Does that label accurately reflect your car's condition just before the accident?

Part 2: The Comparable Vehicles List

Next is the list of "comparable" vehicles, or "comps." These are supposedly similar cars for sale at local dealerships that the software uses to create a baseline market value. The keyword here is supposedly—"similar" can be a flexible term when an insurance company is trying to save money.

Keep an eye out for these red flags:

- Mismatched Features: Are they comparing a base model to your fully loaded vehicle?

- Geographic Location: Are the comps from a different region or a "Salt Belt" state where road salt and rust diminish vehicle values?

- Dealer Type: Are the cars listed at budget lots instead of reputable, certified dealerships?

A single poorly chosen comparable vehicle can drag down the average value of the entire list, directly lowering your insurance total loss payout. Always question comps that don't seem like a true match.

Part 3: The Adjustments Breakdown

Finally, you get to the adjustments section. This is where the CCC ONE software adds or subtracts dollar amounts to the comps to account for differences between them and your car. This part of the report is highly subjective and a prime spot for insurers to reduce your payout.

Pay close attention to any negative adjustments, as these are direct deductions from your car's value. You'll often see deductions for minor scratches, normal tire wear, or prior repairs. If these feel excessive for a car of its age and mileage, they are perfect candidates to dispute.

Finding Common Errors in Your CCC ONE Market Valuation Report

The CCC ONE Market Valuation Report is automated, but its final number is only as good as the information an adjuster inputs. Since insurers control the data, the process is prone to errors—both accidental and intentional—that almost always work in their favor.

This is where you can take back control. Spotting these common inaccuracies is the key to challenging a low settlement and getting the fair insurance total loss payout you're owed. For example, if your car had a premium trim package but the report lists it as a base model, that single "mistake" could cost you thousands.

Your Actionable Checklist for Spotting Errors

Treat your CCC ONE report like a detailed receipt—you need to check every line item. Most people only look at the final number, but the real story is buried in the details. Use this checklist to identify the most common red flags.

-

Incorrect Trim and Options: Is your vehicle’s trim level (e.g., LX, EX, Sport) listed correctly? Did they account for your sunroof, premium audio system, or factory navigation? Missing these high-value features is one of the quickest ways insurers undervalue a car.

-

Unfair Condition Adjustments: Look for any deductions labeled "condition adjustment." Insurers often apply harsh penalties for normal wear and tear, like minor scuffs or typical tire wear, that wouldn't actually impact a vehicle's real-world sale price.

-

Poorly Chosen Comparables: Scrutinize the "comparable" vehicles. Are they truly similar to yours? Watch out for comps from distant areas, especially "Salt Belt" states where rust is common, or base models used to value your fully-loaded car. Understanding this tactic is also helpful for diminished value claims.

-

Ignoring Recent Upgrades: Did you recently install new tires, brakes, or have a major service performed? These investments add real value and should be credited in the report. If they’re missing, it’s a clear sign of an incomplete valuation.

By carefully reviewing each section, you shift the power dynamic. You are no longer just accepting a number; you are actively verifying its accuracy, prepared to question every detail.

Each mistake you find is another piece of evidence you can use to build your case. Don’t just assume the report is correct because it looks official. Arm yourself with the facts and get ready to challenge any discrepancies you uncover.

How to Dispute an Unfair Total Loss Offer

Spotting mistakes in your CCC ONE Market Valuation Report is a significant step, but it’s just the beginning. Now, you need to turn that evidence into a successful dispute to get the fair payout you’re owed. This process isn’t about emotion; it’s about presenting a calm, organized, and evidence-based case.

Your goal is to reframe the conversation around facts. You need to build a rock-solid counter-argument, and that starts with gathering your own proof.

Pull together all documentation for your vehicle:

- Maintenance Records: Receipts for oil changes, new tires, brake jobs, or other major work prove you took excellent care of your car.

- Proof of Upgrades: If you installed an aftermarket stereo, custom wheels, or other parts, find the receipts to prove their added value.

- Local Market Research: Search for similar vehicles for sale at reputable dealerships in your area. Take screenshots of listings that are a closer match to your car's trim, mileage, and condition.

Presenting Your Case to the Adjuster

Once you have your evidence, communicate clearly and professionally by drafting a formal email or letter to the adjuster. Outline every error you found in their report and attach your supporting documents as proof. To make a real impact, mastering a few proven strategies to negotiate with an insurance adjuster is a game-changer.

Think about it this way: financial markets run on hard data, not guesswork. As of mid-2025, the global stock market hit an eye-watering $127 trillion valuation, with $62.2 trillion of that in the U.S. alone. Just as investors use precise data to value a company, you need to use concrete evidence to establish your vehicle’s true worth.

When Evidence Isn't Enough

Sometimes, even with solid proof, an adjuster won't negotiate. This is the moment when an independent, certified appraisal from SnapClaim becomes your most powerful tool. It’s not just another opinion—it’s a legally defensible document created by an expert using court-accepted methods.

A SnapClaim report forces the adjuster to justify their lowball offer against a certified, data-backed valuation. If they still refuse, you can formally demand an independent valuation by invoking the appraisal clause in your insurance policy. This clause is a potent, and often overlooked, tool for settling valuation disputes.

Arming Yourself with a SnapClaim Appraisal

So you’ve presented your evidence, but the insurance adjuster won’t budge on their low offer. Now is the time to escalate. An independent, professional appraisal is your ultimate tool for breaking the stalemate. This is where a SnapClaim report provides the leverage you need.

Unlike the insurer's automated printout, a SnapClaim appraisal is prepared by certified experts. We use court-accepted methodologies to build a defensible, data-backed valuation of what your vehicle was actually worth. It changes the conversation from their biased report versus your opinion to their report versus your expert's professional findings.

Why a SnapClaim Report Carries More Weight

A SnapClaim report is more than a second opinion—it’s professional-grade evidence built to strengthen insurance disputes. It provides the proof you need to negotiate fairly and strengthens your position.

Our commitment is to help you get a fair outcome without financial risk. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

This Money-Back Guarantee means you can challenge your insurer's valuation with confidence. Just like professional investors use hard data to value companies in the $126.7 trillion global equity market, our reports give you the concrete proof needed to establish your car’s true market value. You can see more on how these massive market trends work at goldmansachs.com.

When you have a certified appraisal, you’re no longer just asking for a fair settlement—you’re demanding it with the evidence to back it up. It signals to the insurer that you’re serious and prepared to fight for what you rightfully deserve.

Frequently Asked Questions (FAQ)

Here are answers to common questions about the CCC ONE Market Valuation Report and the total loss process.

Can I dispute a CCC report myself?

Yes, absolutely. Start by carefully reviewing the report for errors in your vehicle's trim, options, and condition. Gather your own evidence, such as maintenance records and listings for comparable vehicles in your area, and present your findings clearly to the adjuster. If they remain unwilling to negotiate, a certified appraisal from a company like SnapClaim provides the expert leverage you need.

What if the insurer rejects my independent appraisal?

It is very unlikely for an insurance company to reject a professional, data-backed appraisal from a certified expert. If they push back, your next step is to invoke the appraisal clause in your auto insurance policy. This contractual right requires both you and the insurer to hire independent appraisers who will work to agree on a fair value, providing a clear path to resolution.

What if I owe more on my loan than the settlement offer?

This situation is known as being "upside down" or "underwater" on your loan. If the insurance settlement is less than your loan balance, you are responsible for paying the difference. This is why securing a fair car value after an accident is so important—a lowball offer can leave you without a car and with a significant debt.

Can I claim diminished value if the accident wasn’t my fault?

Yes, in most states, you are entitled to file a diminished value claim against the at-fault driver's insurance company. Diminished value is the loss in a vehicle's resale value after it has been in an accident and repaired. Even with perfect repairs, a car with an accident history is worth less than one without. A specialized appraisal is the best way to prove this loss.

Don't let an automated report decide what your car was worth. SnapClaim delivers the certified evidence you need to stand your ground and get the payout you deserve.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

👉 Get your free estimate today

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.