After a car accident, one of the biggest questions is, “Is my car totaled?” Understanding this process is the first step toward getting a fair settlement from your insurance company. This guide will help you learn how to tell if my car is totaled by showing you what to look for and explaining how insurance companies make their decision.

In simple terms, an insurance company declares a car a total loss when the cost to repair it is more than a certain percentage of its value right before the crash. While only your insurance adjuster can make the final call, there are clear signs you can spot yourself.

Spotting the Obvious Red Flags of a Total Loss

Once everyone is safe and the scene is secure, take a moment to inspect your vehicle. This initial check isn’t an official appraisal, but it can give you a realistic idea of what to expect.

Insurance adjusters are trained to spot specific types of damage that almost always cause repair costs to skyrocket, pushing a car into “total loss” territory. Knowing what they look for helps you prepare for the conversation with your insurance company and brace for the likely outcome.

Significant Structural Damage

The most significant sign of a potential total loss is damage to your car’s frame or unibody. Think of the frame as the vehicle’s skeleton—if it’s bent, twisted, or cracked, the car’s core integrity is compromised. This is a massive safety issue, not just a cosmetic one.

Keep an eye out for these tell-tale indicators:

- Doors That Don’t Open or Close Correctly: If a door is suddenly difficult to shut or won’t line up with the body, it’s a strong hint that the car’s frame has been warped.

- Uneven Gaps Between Body Panels: Look at the spaces between the hood, fenders, and doors. If they are wider or tighter than before, it points to a major shift in the underlying structure.

- Bent Pillars or a Caved-In Roof: Damage to the pillars supporting the roof is a serious safety concern and is incredibly expensive to repair properly.

Deployed Airbags and Interior Damage

Modern safety systems save lives, but they are shockingly expensive to replace. If multiple airbags deployed in the crash, the repair bill can spiral out of control. A single airbag replacement can cost $1,000 to $2,000, so several deployments can be enough to total an older vehicle.

An adjuster will also assess severe interior damage from fire, water, or the impact itself. Flood damage, in particular, often leads to a total loss because it creates hidden, long-lasting electrical problems that are nearly impossible to fix reliably.

Quick Checklist for Potential Total Loss

| Damage Indicator | What It Means for Your Car | Why It Often Leads to a Total Loss |

|---|---|---|

| Twisted Frame | The vehicle’s core “skeleton” is compromised. | Extremely expensive and difficult to repair safely. |

| Deployed Airbags | Multiple safety systems must be replaced. | The cost of parts and labor can exceed the car’s value. |

| Major Flood Damage | Water has infiltrated the engine, electronics, and interior. | Causes widespread, hidden electrical problems. |

| Severe Front/Rear Impact | The engine, transmission, or axle is heavily damaged. | Repair costs for core mechanical components are huge. |

| Roof or Pillar Damage | The car’s rollover protection is weakened. | Structural integrity is compromised, making it unsafe. |

If you see one or more of these signs, it’s time to start preparing for the possibility that your car will be declared a total loss.

How Insurance Companies Calculate a Total Loss

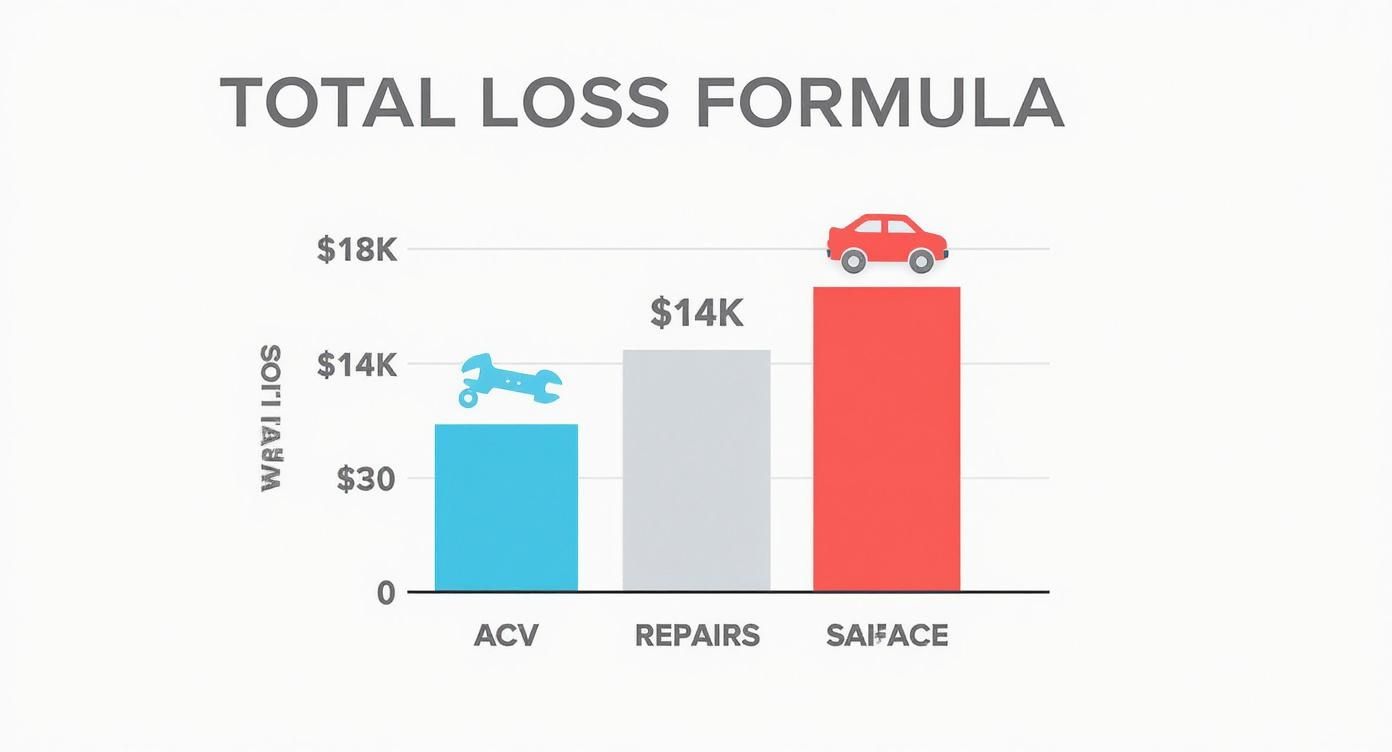

When your car is badly damaged, the insurance company uses a specific formula to determine if it’s a total loss. It all comes down to comparing the estimated repair cost to your car’s Actual Cash Value (ACV). ACV is simply what your vehicle was worth on the open market a moment before the crash.

The Math Behind the Decision

The formula insurance adjusters use looks like this:

Repair Costs + Salvage Value > Actual Cash Value (ACV) = Total Loss

Let’s break that down into simple terms:

- Repair Costs: The full estimate from the body shop to restore your car to its pre-accident condition.

- Salvage Value: What the insurance company can get by selling your wrecked car to a salvage yard for parts.

- Actual Cash Value (ACV): The market value of your car right before the accident, based on its age, mileage, condition, and recent sales of similar cars in your area.

For example, say your car’s pre-accident ACV was $18,000. The body shop estimates repairs at $14,000. The insurer knows it can get $4,500 for the wreck from a salvage auction.

Here, the repair cost ($14,000) plus the salvage value ($4,500) equals $18,500. Because that total is more than the car’s $18,000 ACV, the insurance company will declare it a total loss. It’s cheaper for them to give you a check for the ACV and sell the salvage than to pay for the repairs.

The problem is, an insurer’s first ACV offer is often lower than expected. A professional, independent appraisal provides the proof you need to negotiate a fair insurance total loss payout.

Understanding State Laws and Total Loss Thresholds

Why does a car with major damage get repaired in one state but totaled in another? The answer often lies in state-specific regulations.

Each state sets its own rule for when an insurer must declare a vehicle a total loss. This rule is called the Total Loss Threshold (TLT), and it’s a percentage of the car’s ACV. If the repair estimate exceeds this percentage, the vehicle must be totaled.

How State Thresholds Impact the Outcome

Let’s use an example. Imagine your car has a pre-accident ACV of $20,000 and needs $16,500 in repairs. This is a repair-to-value ratio of 82.5%.

- In a state like Colorado with a 100% threshold, your car would likely be repaired because the cost doesn’t exceed the ACV.

- But in Nevada, where the threshold is 65%, your car would be an automatic total loss.

| State | Total Loss Threshold (%) | Outcome for a $20,000 Car with $16,500 in Repairs |

|---|---|---|

| Colorado | 100% | Repaired. The 82.5% repair cost is below the state limit. |

| Texas | 100% (Total Loss Formula) | Likely Repaired. The insurer will also factor in salvage value. |

| Iowa | 70% | Totaled. The 82.5% repair cost is well above the state limit. |

| Nevada | 65% | Totaled. The insurer has no choice but to declare it a total loss. |

Some states use a “Total Loss Formula” (TLF) instead of a strict percentage. In these states, a car is totaled if the cost of repairs plus its salvage value exceeds its ACV.

Where Your State Stands

Knowing your state’s specific threshold gives you a huge advantage when speaking with an adjuster. Thresholds vary widely, but most states hover around the 75% mark.

You can look up the total loss threshold by state to find the rules where you live. For a deeper look, check out our guides on state-specific laws.

What to Do When You Disagree with the Insurance Offer

Getting a low settlement offer for your totaled car can feel like a final blow after a stressful accident. But remember, the insurer’s first number is an offer, not a final decision. You have the right to challenge it and negotiate for a payout that reflects your car’s true value.

Insurance companies often use valuation reports that can undervalue your vehicle by using outdated market data or missing your car’s specific features. Your job is to prove your car’s true Actual Cash Value (ACV) right before the accident.

Building Your Counter-Offer

To effectively dispute a lowball offer, you need a solid case backed by evidence. Start by doing your own market research to find “comps”—comparable vehicles for sale in your local area with similar make, model, year, mileage, and condition.

Next, document everything that adds value to your car:

- Maintenance Records: Proof of regular service shows your car was well-maintained.

- Recent Upgrades: Pull out receipts for new tires, brakes, or a battery.

- Special Features: Highlight any factory options or aftermarket additions.

The strongest tool in your negotiation is an independent appraisal. A SnapClaim report provides unbiased, data-backed proof of your vehicle’s fair market value, giving the insurer a professional valuation they can’t easily dismiss. This certified data helps strengthen your claim and supports your case for fair compensation.

For a more detailed walkthrough, check out our guide on disputing a total loss offer.

What to Do After Your Car Is Totaled

Once your car is officially declared a total loss, you face a key decision. Most people accept the settlement check, hand over the title, and let the insurer take the wrecked vehicle. It’s a clean and straightforward process.

However, you have another option: you can choose to retain the salvage.

Keeping Your Totaled Car

Retaining the salvage means you keep the damaged car. The insurance company pays you the car’s Actual Cash Value (ACV) but subtracts the amount they would have received from a salvage auction. Your final payout becomes the ACV minus the salvage value.

This path isn’t for everyone and comes with significant hurdles:

- A Branded Title: Your car will be issued a salvage title, permanently marking it as a total loss.

- Repairs and Inspections: You are responsible for all repairs, and the car must pass a strict state inspection to get a “rebuilt” title before it can be driven legally.

- Insurance Difficulties: It can be very hard to find an insurance company willing to offer more than basic liability coverage on a rebuilt vehicle.

Before choosing this route, you should understand the real value of a totaled car. For a closer look at what your policy covers, it’s always a good idea to review this guide on understanding your insurance policy and coverage details.

What If You Still Have a Car Loan?

If you are still paying off the car, the settlement check from your insurer goes directly to your lender. If that check isn’t enough to cover what you owe, you are responsible for paying the difference. This is why GAP (Guaranteed Asset Protection) insurance is so valuable, as it covers the “gap” between the ACV payout and your remaining loan balance.

How to Get Fair Compensation for Your Totaled Car

Knowing how to tell if my car is totaled is just the first step. The next is ensuring you receive a fair settlement that allows you to replace your vehicle without financial strain. An independent, certified appraisal from SnapClaim provides the data-backed proof you need to negotiate confidently with the insurance company.

Our reports use advanced market analysis to determine your vehicle’s true pre-accident value, strengthening your claim for the compensation you deserve. And with SnapClaim’s Money-Back Guarantee, you can proceed with confidence. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

Don’t let the insurance company dictate your car’s value. Take control of your claim today.

“Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.”

Frequently Asked Questions (FAQ)

How long does a total loss claim typically take?

A total loss claim usually takes a few weeks, but the timeline can vary. The process includes the vehicle inspection, the adjuster’s valuation, settlement negotiation, and final payment. Delays can happen if there are disagreements over the vehicle’s value or issues with paperwork, so having your documents in order helps speed things up.

What if my insurance company’s offer is too low?

You do not have to accept the first offer. If you believe the insurance company has undervalued your vehicle, you can negotiate by providing evidence of its true market value. This can include finding comparable vehicle listings, showing maintenance records, and, most effectively, presenting a certified third-party appraisal report from a service like SnapClaim.

Can I claim diminished value if my car is declared a total loss?

No, diminished value claims only apply to vehicles that are repaired after an accident. A diminished value claim compensates you for the loss in resale value your car suffers because it now has an accident history. A total loss settlement is intended to pay you the full pre-accident value of the car, so there is no remaining value to be diminished.

What happens if I still owe money on my totaled car?

If you have an outstanding loan, the insurance company will pay the settlement amount directly to your lender first. If the payout is less than what you owe, you are responsible for paying the remaining balance. This is where GAP (Guaranteed Asset Protection) insurance can help, as it is designed to cover this difference.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.