A total loss evaluation begins the moment your insurance company suspects that fixing your car will cost more than it was worth before the accident. This isn’t just about how bad the damage looks—it’s a financial decision. Understanding how this process works is the first step to ensuring you receive a fair insurance total loss payout.

What It Means When Your Car Is a Total Loss

Hearing “your car is a total loss” can feel overwhelming, but it simply means your vehicle has reached an economic point of no return for the insurer. An adjuster inspects the damage and estimates the total cost of parts and labor for repairs.

That repair estimate is then compared to your vehicle’s Actual Cash Value (ACV)—a technical term for what your car was worth right before the crash.

If the repair bill crosses a certain percentage of the ACV, the insurer must declare it a total loss. This percentage is called the Total Loss Threshold (TLT), and it varies by state.

The Total Loss Threshold Explained

The TLT is a rule set by each state’s Department of Insurance that tells an insurer when they must brand a vehicle as a total loss. These thresholds typically range from 50% to 100% of the car’s ACV.

For example, let’s say your car’s ACV was $15,000 and your state has a 75% TLT. If the repair estimate is $11,250 or more ($15,000 x 0.75), the car is automatically totaled. These rules prevent insurers from spending excessive money on a vehicle that has lost most of its value.

A “total loss” doesn’t always mean your car is a twisted pile of metal. Sometimes, moderate damage to an older car with a low pre-accident value is all it takes to push it over the threshold.

Key Terms in Your Total Loss Claim

Navigating a total loss claim means you’ll encounter some specific industry terms. Here’s a simple breakdown of the essential vocabulary you need to know.

| Term | What It Means for You |

|---|---|

| Actual Cash Value (ACV) | This is the fair market value of your vehicle right before the accident. It’s what your settlement is based on. |

| Total Loss Threshold (TLT) | A percentage set by your state. If repair costs exceed this percentage of the ACV, the car is legally a total loss. |

| Salvage Value | The amount the insurer can get by selling your wrecked car to a salvage yard for parts. This affects their financial calculation. |

| Appraisal | An independent, professional valuation of your vehicle’s worth, often used to challenge a low ACV from an insurer. |

Understanding these terms is critical because they form the basis of your insurer’s settlement offer. Don’t be afraid to ask your adjuster to explain how they arrived at each number.

Key Factors in the Evaluation

The decision to total your car isn’t random; it’s a math problem based on three key numbers:

- Estimated Repair Costs: The total bill for parts and labor to restore the vehicle to its pre-accident state.

- Actual Cash Value (ACV): The car’s fair market value, factoring in its make, model, year, mileage, options, and overall condition before the crash.

- Salvage Value: What the insurance company thinks it can sell your wrecked car for at a salvage auction.

The insurer uses these numbers to decide which path is cheaper for them: repair it or pay you out. Knowing these core concepts empowers you to follow their logic—and to spot where they might have gotten it wrong. For a closer look at the rules in your area, checking your state’s specific law pages can give you a major advantage.

How Insurers Determine Your Car’s Pre-Accident Value

After an accident, the most important number in your total loss evaluation is your vehicle’s Actual Cash Value (ACV). This isn’t what you paid for the car or what a new one costs. ACV is what your exact car—with its specific age, mileage, and condition—would have sold for just moments before the collision.

To calculate this, insurance companies use third-party valuation software like CCC ONE or Mitchell. These platforms scan huge databases for recently sold vehicles in your local area that are a close match to yours.

The system is built for speed, not always accuracy, and this is where problems often begin.

Where These Automated Valuations Go Wrong

The biggest issue with automated systems is that they’re blind to the details that made your car unique. An algorithm can’t see the spotless interior you maintained or know you just spent $1,000 on new tires.

This is where most settlement offers fall short. Here are common mistakes that can cost you thousands:

- Bad Condition Ratings: An adjuster who never saw your car might rate it as “average” condition by default, instantly lowering its value.

- Missing Features and Options: The report often overlooks valuable factory upgrades like a premium sound system, sunroof, or advanced safety package.

- Poor “Comps” (Comparable Vehicles): The system might compare your fully-loaded model to base models, cars with far more miles, or vehicles from a cheaper market.

Think of the insurer’s valuation report as their opening offer, not the final word. You have the right to review it line by line and point out any errors.

Why More Cars Are Being Totaled

It’s also worth knowing that cars are declared total losses more frequently now. Repair costs are skyrocketing due to supply chain issues and expensive modern parts. For insurers, the math has changed.

It’s now common for over 20% of collision claims to be written off as total losses simply because fixing them is too expensive. This means even moderate damage can push a repair bill past the point of no return, making an accurate total loss evaluation more critical than ever for car owners.

Taking Control of Your Car’s Value

At the end of the day, the insurance company’s ACV report is just their opinion. You have the right to challenge it with your own evidence. By gathering maintenance records, receipts for recent upgrades, and market research on similar cars for sale, you can build a strong case for a higher, fairer value.

Understanding the components of your car’s worth is the first step to a fair payout. For a deeper dive, check out our guide on what your car’s Actual Cash Value truly means and how to prove it. This knowledge helps you spot errors and negotiate from a position of strength.

The Math Behind a Total Loss Insurance Payout

When an adjuster declares your car a total loss, it’s based on a clear formula. Insurance companies use this math to decide if it’s cheaper to pay for repairs or write you a check for your car’s value.

There are two main methods insurers use, depending on your state’s laws. The most common is the Total Loss Threshold (TLT), a simple percentage-based rule. The other is the Total Loss Formula (TLF), which includes the car’s scrap value.

The Total Loss Threshold in Action

Let’s walk through a real-world example of the Total Loss Threshold. Imagine your car’s Actual Cash Value (ACV) is correctly set at $20,000, and you live in a state with a 75% TLT.

The math is simple:

$20,000 (ACV) x 0.75 (TLT) = $15,000

This number is the threshold. If the body shop’s repair estimate is $15,000 or higher, your insurer is legally required to total the vehicle.

The Total Loss Formula Explained

Some states don’t use a strict TLT, which is where the Total Loss Formula (TLF) comes in. This is an internal economic calculation for the insurer.

The Total Loss Formula compares costs. It adds the cost of repairs to the car’s projected salvage value. If that total is more than the car’s ACV, it’s a total loss.

Let’s use our $20,000 ACV example. This time, the repair estimate is $14,000. However, the insurance company knows it can sell your wrecked car at a salvage auction for $6,500.

Here’s how they run the numbers:

$14,000 (Repair Cost) + $6,500 (Salvage Value) = $20,500

Since $20,500 is greater than the $20,000 ACV, the insurer will declare it a total loss. Even though the repair costs didn’t meet the state threshold, it’s simply cheaper for them to pay you out.

For a deeper dive into these numbers, you can check out our complete guide on calculating a total loss vehicle to see how different scenarios play out.

Comparing Both Total Loss Methods

While both the TLT and TLF can lead to the same outcome, one is a strict state rule, and the other is a financial decision for the insurer.

Here’s a quick comparison to make the difference clear.

| Method | How It Works | Example (ACV = $20,000) |

|---|---|---|

| Total Loss Threshold (TLT) | A state-mandated percentage. If repair costs exceed this percentage of the ACV, it’s a total loss. | If the threshold is 75%, any repair estimate over $15,000 automatically totals the car. |

| Total Loss Formula (TLF) | An economic formula. If Repair Costs + Salvage Value is greater than the ACV, it’s a total loss. | If repairs are $14,000 and salvage is $6,500, the $20,500 total exceeds the $20,000 ACV. |

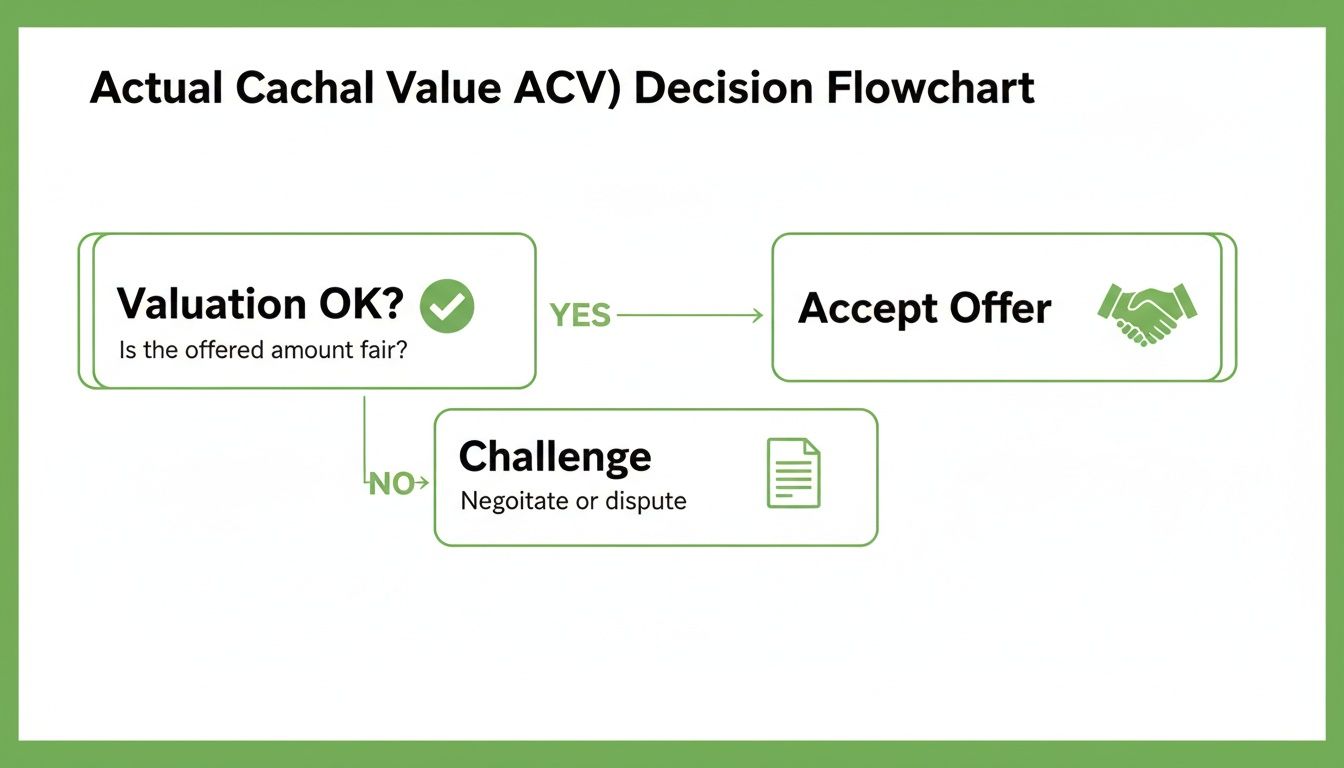

Once you receive the valuation report from the adjuster, you have a decision to make. This flowchart breaks down your options.

As you can see, your first move is to decide if the insurer’s ACV is fair. If it’s not, your next step is to gather evidence and push back. No matter which formula your insurer uses, everything hinges on an accurate ACV.

How to Build Your Case for a Higher Payout

Receiving a low settlement offer is frustrating, but your best move is a calm, organized, and data-driven counter-offer. Winning a total loss evaluation dispute comes down to one thing: proving your vehicle’s true pre-accident value with evidence the insurer can’t ignore.

Your first step is simple. Formally request the insurance company’s complete valuation report. This document is the blueprint for their offer, and you have every right to review it.

Scrutinize the Insurer’s Valuation Report

Once you have the report, it’s time to check it for errors. You’re looking for mistakes, omissions, and wrong assumptions that lowered your car’s value.

Focus on these common problem areas:

- Vehicle Condition: Did they label your well-maintained car as “average” without ever seeing it? This is a common tactic that can cost you thousands.

- Mileage Errors: Make sure the mileage is correct. A simple typo can make a huge difference.

- Missing Features and Trim: Is your premium trim package listed? Did they include the sunroof, leather seats, or upgraded sound system?

- Flawed “Comps”: Look closely at the comparable vehicles (“comps”) they used. Are they truly similar? Watch out for base models, cars with more miles, or listings from a cheaper market.

The insurer’s report is their side of the story, written to protect their bottom line. Your job is to correct that story with facts.

Gather Your Own Evidence

An emotional plea won’t sway an adjuster. What works is a well-documented counter-offer packed with proof. Your goal is to build a file that makes your car’s true condition and value undeniable.

Here’s the essential documentation you should collect:

- Maintenance Records: Gather receipts for oil changes, tire rotations, and regular service. A consistent maintenance history is powerful proof of a well-cared-for vehicle.

- Receipts for Recent Upgrades: Did you install new tires or upgrade the stereo recently? Any money you put into the car adds to its pre-accident value.

- Original Window Sticker: If you still have it, the original window sticker is the ultimate proof of every factory-installed option.

- Pre-Accident Photographs: Photos showing your car in clean, pre-accident condition can instantly counter an unfair “average” condition rating.

Find Your Own Comparable Vehicles

Now it’s time for your own market research. Use sites like Autotrader, Cars.com, and Kelley Blue Book to find listings for the exact same make, model, year, and trim as your car. Try to keep your search within a reasonable local radius.

Focus on listings from reputable dealerships, as their prices better reflect the true retail value you’re entitled to. Save screenshots or printouts of these ads. This creates a powerful, data-backed snapshot of what your car was really worth.

When you present this evidence to the adjuster, you shift the conversation from their flawed report to the reality of the local market. A certified appraisal report from SnapClaim makes this position even stronger, providing the proof you need to negotiate fairly.

The Power of a Certified Appraisal in a Total Loss Dispute

Challenging your insurer’s low offer with your own research is a great start, but it often leads to a stalemate. You have your numbers, they have theirs, and the adjuster has little incentive to agree with you. This is where a certified, independent appraisal becomes your most powerful tool in a total loss evaluation.

An insurer’s valuation comes from automated software that often misses your vehicle’s unique details. A certified appraisal, on the other hand, is a detailed report created by a human expert who understands the real-world car market.

Why an Appraisal Is More Than Just a Second Opinion

A professional appraisal is a defensible, court-accepted document. It forces the adjuster to look beyond their internal software and deal with a value grounded in unbiased methods. Think of it as bringing in an expert witness to establish the facts.

An independent appraisal provides the proof you need to negotiate fairly. It replaces the insurer’s assumptions with a data-driven Fair Market Value that stands up to scrutiny, giving them a clear reason to increase their offer.

This flips the dynamic. Instead of you trying to prove their report is wrong, the burden shifts to them. They now have to justify why their automated number is more accurate than an expert’s detailed findings. For a full breakdown of the process, you can learn more about what a professional car appraisal entails and why it’s so effective.

A Risk-Free Path to a Fairer Settlement

Many people hesitate to pay for an appraisal, worried about the cost. At SnapClaim, we understand that concern and have eliminated the risk. We are so confident in our certified reports that we back them with a 100% Money-Back Guarantee.

Our guarantee is simple: if your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee. This makes ordering a report a risk-free investment in getting the fair insurance total loss payout you deserve. It helps strengthen your claim so you can negotiate with confidence, knowing you have a team of experts on your side.

Frequently Asked Questions (FAQ)

Can I keep my car if it is a total loss?

Yes, in most states, you can choose to “retain salvage” and keep your car. The insurance company will pay you the car’s actual cash value minus its salvage value (what they would have received from a salvage yard). Your car will be issued a salvage title, which can make it difficult to insure or sell later, and you’ll be responsible for all repairs needed to make it roadworthy again.

What if I owe more on my car loan than the settlement?

This is known as being “upside down” on your loan. The insurance payout goes directly to your lender first. If the settlement is less than your loan balance, you are responsible for paying the remaining amount. This is where GAP (Guaranteed Asset Protection) insurance can help, as it’s designed to cover this exact shortfall.

How does the appraisal clause in my policy work?

The appraisal clause is a tool in your policy to resolve valuation disputes. If you and your insurer can’t agree on your car’s value, you can invoke it. You hire your own appraiser, the insurer hires theirs, and the two appraisers select a neutral third appraiser (an umpire). A binding value is set once any two of the three agree.

Will a total loss claim increase my insurance rates?

It depends on who was at fault for the accident. If the other driver was 100% at fault, your rates should not increase, as their insurance is covering the claim. If you were at fault, your rates will likely go up at your next renewal, just as they would for any at-fault claim. If you want to dig deeper into how damaged vehicles are classified, you can explore the different UK write-off categories for some additional context on the process.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

👉 Get your total loss appraisal today