When an insurance company declares your car a “total loss,” what they’re really talking about is its Actual Cash Value (ACV). ACV is a snapshot of what your car was worth right before the accident, not what you paid for it or what a new one costs. Understanding ACV is the first step toward getting the fair insurance total loss payout you deserve.

Your Car Is Totalled. Now What?

Hearing the words “total loss” from your insurer is a gut punch. It means they’ve decided the cost to repair your car is more than its pre-accident value. While that’s never good news, it’s important to remember that this is the start of a negotiation, not the final word.

The insurance company will now calculate your car’s ACV to determine their payout offer. They look at several factors, but their initial assessment often misses key details. This is why their first offer is often just a starting point, and you have the right to challenge it.

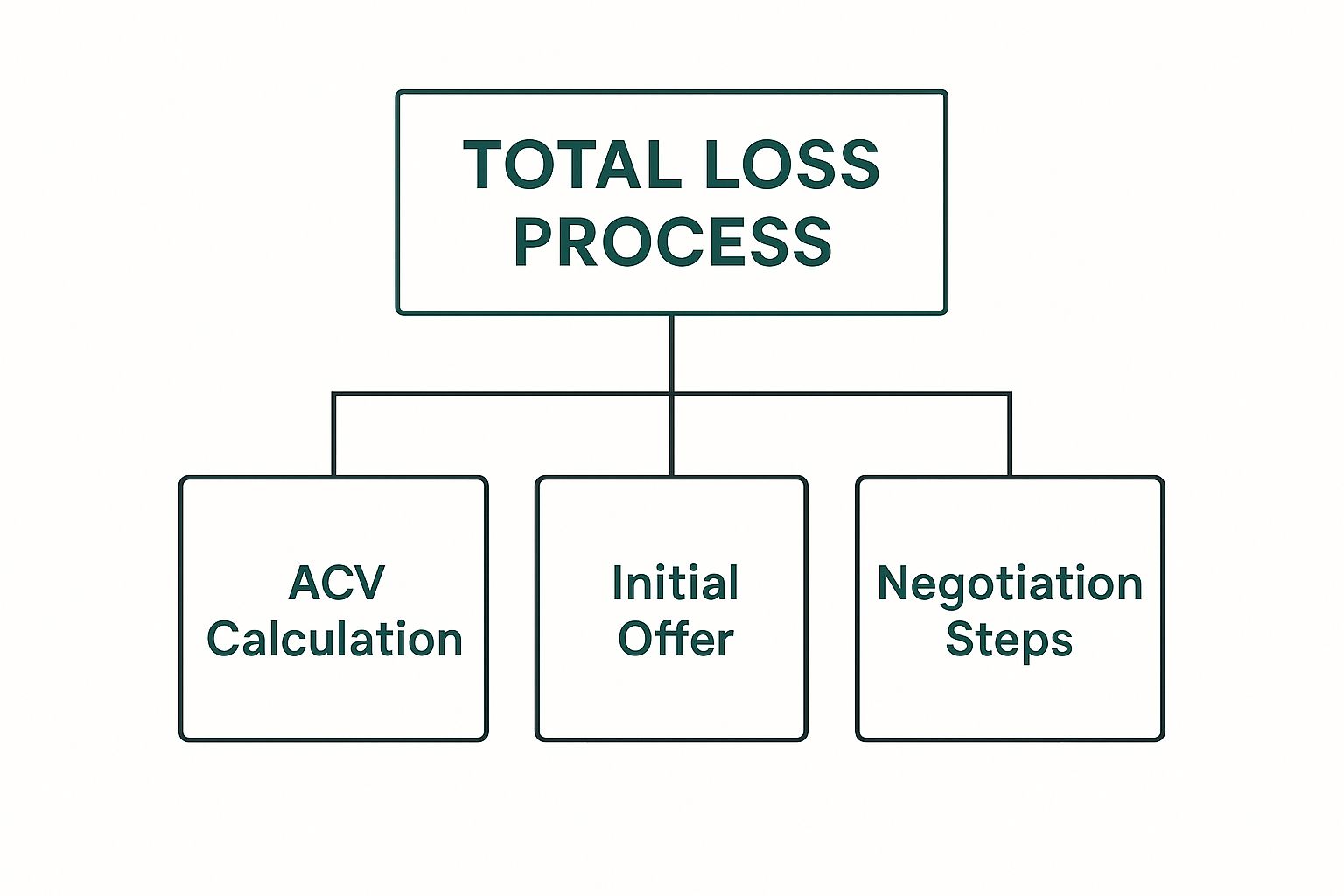

Understanding the Total Loss Process

Navigating a total loss claim isn’t a single event; it’s a process. It moves from the insurer’s initial valuation to your negotiation and, finally, to the settlement.

This diagram breaks down the typical flow. It starts with the ACV calculation, leads to the insurer’s offer, and highlights your opportunity to push back with better evidence.

As you can see, negotiation is a built-in part of the process. This is your chance to dispute their number if you believe it’s too low.

To get the fair payout you deserve, you need to understand exactly how the value of a totalled car is calculated. The insurer’s total loss payout is heavily influenced by a few key factors:

- Vehicle Condition: This is the overall shape your car was in right before the crash. Was it meticulously maintained, or did it have some pre-existing dings and scratches?

- Mileage: It’s simple—lower mileage almost always means a higher value.

- Recent Upgrades: Did you just drop money on new tires, a new battery, or significant engine work? These improvements can add real value that the insurer might overlook.

- Local Market Prices: What are cars just like yours actually selling for in your area? This is a huge piece of the puzzle.

Once you get a handle on these elements, you can review the insurance company’s offer with confidence and come to the table prepared to negotiate a fair settlement.

Decoding Actual Cash Value (ACV)

Before you can determine the value of a totalled car, you must understand the most important term in any insurance claim: Actual Cash Value (ACV).

Simply put, ACV is what your car was worth on the open market moments before the accident. It’s not the original sticker price or the cost of a brand-new replacement. An insurance adjuster is supposed to analyze your car’s age, condition, features, and local market data to arrive at this figure.

The goal of the insurance payout is to compensate you for the exact value you lost. However, the insurer’s first calculation often misses key details, which is why understanding how they build that number is your first step toward a fair settlement.

The Core Components of Your Car’s Value

Insurance companies use valuation software to generate a base value for your car. The accuracy of this value depends entirely on the data they input.

Here are the main ingredients that go into the ACV recipe:

- Year, Make, and Model: This is the starting point. A 2022 Honda Accord has a different baseline value than a 2018 Ford F-150.

- Mileage: Lower mileage almost always means higher value. A car with 50,000 miles is worth more than the same one with 150,000 miles.

- Overall Condition: This is a huge factor. Was your car in excellent condition, or did it have dings, faded paint, and interior wear?

- Trim Package and Options: A base model is worth less than a fully loaded one. Features like a sunroof, leather seats, or advanced safety tech add value that can be overlooked.

- Local Market Data: The insurer analyzes recent sales of comparable vehicles in your specific area to see what a buyer would have paid for your car.

To see how these elements come together, the table below shows what each factor means for your settlement and how you can provide proof to support your car’s true value.

Key Factors Influencing Your Car’s Actual Cash Value

| Valuation Factor | What It Means for Your Payout | How to Document It |

|---|---|---|

| Year, Make, & Model | The foundation of your car’s value. | Your vehicle registration or title. |

| Mileage | A primary driver of depreciation. Lower is better. | Photos of the odometer, service records. |

| Overall Condition | Reflects wear and tear. “Excellent” vs. “Fair” can mean thousands. | Dated photos/videos, detailed maintenance logs. |

| Trim & Options | Upgrades add significant value but are often missed by insurers. | Original window sticker, bill of sale, photos. |

| Recent Upgrades | New tires, engine work, or tech can boost value. | Dated receipts for parts and labor. |

| Local Market Data | Determines what a “willing buyer” would pay in your area. | Find comparable vehicle listings on sites like AutoTrader. |

Understanding these factors is crucial because it helps you spot where an insurer’s valuation might have gone wrong.

Where Insurers Often Miss Important Details

The automated tools insurers use are notorious for missing the unique qualities of your vehicle. This is exactly where most initial settlement offers fall short.

For instance, did you just put a set of brand-new tires on last month? Did you recently have the transmission replaced? An automated report probably won’t know that, and you’ll be leaving money on the table if you don’t speak up.

An insurer’s valuation report is a starting point, not a final verdict. It is your right to review it for accuracy and provide documentation for any features, upgrades, or exceptional maintenance that adds to your car’s value.

This is why gathering your own evidence is so critical. Dig up those receipts for major repairs. Find the paperwork for recent upgrades. By presenting these facts, you help paint a much more accurate picture of what your car was really worth.

Why Insurance Payouts Are Often Too Low

It’s a moment every car owner dreads. You file a claim for your totalled car, and the insurance company’s first offer is way lower than you expected. You know what your car was worth, and this just doesn’t feel right.

If this sounds familiar, you’re not alone. The reason for the lowball offer usually isn’t personal; it’s automated. Insurers lean heavily on third-party software to calculate the value of a totalled car. These systems are built for speed and volume, not for capturing the specific, true value of your individual vehicle.

The Problem with Automated Valuations

The software your insurer uses scrapes data to produce a valuation report, but its methods are far from perfect. These systems are known for making critical mistakes that can cost you thousands.

Here are the most common errors we see:

- Using Distant Comparables: The software may compare your car to vehicles for sale hundreds of miles away, in a completely different market where prices are lower.

- Applying Harsh Deductions: These reports often apply aggressive, one-size-fits-all deductions for “wear and tear,” treating minor scuffs like major defects.

- Overlooking Key Features: Did you have a premium sound system or a rare factory trim package? Automated systems almost always miss these valuable options.

- Ignoring Recent Upgrades: That brand-new set of tires or the major engine service you just paid for? They’re invisible to the software, even though they add real value.

In short, the insurer’s system isn’t valuing your car. It’s valuing a generic, stripped-down version of it. That’s why their first offer is just that—an offer, not the final word.

Rising Costs and Increased Total Loss Claims

The auto claims landscape is shifting, making accurate valuations more important than ever. In the United States, a significant portion of collision claims are now declared total losses. This isn’t because cars are damaged more easily, but because they are becoming incredibly expensive to repair.

The complexity of modern vehicle technology and rising parts costs are inflating repair bills. This economic pressure means insurers are processing more total loss claims than ever, forcing them to rely on their imperfect automated systems. You can learn more about how market forces are reshaping auto claims.

Because of these systemic issues, it falls on you to bridge the gap between their low offer and your car’s actual worth. The only way to do that is by providing the specific evidence their automated report missed.

How to Dispute an Undervalued Offer

When you get a settlement offer for your totaled car, it can feel final. But it’s critical to remember their initial number is just an opening offer. You have the right to question their math and present your own evidence to get the fair value of a totalled car.

A successful dispute isn’t about arguing; it’s about building a logical, fact-based case that demonstrates a higher, more accurate Actual Cash Value (ACV).

Step 1: Start with Their Report

Your first move is to request a complete copy of the insurer’s valuation report. This document is the blueprint for their offer. Go through it line by line, looking for common errors:

- Incorrect Mileage: Is the mileage listed higher than what was on your odometer?

- Missing Features: Did they forget your sunroof, leather seats, or advanced safety package?

- Wrong Trim Level: Is your car listed as a basic model when it’s actually a fully-loaded trim?

- Unfair Condition Rating: Did they rate your well-maintained vehicle as “fair” or “poor” without justification?

Finding these mistakes gives you immediate, concrete points to discuss with the claims adjuster. This is often the fastest way to get an initial offer increased.

Step 2: Build Your Counter-Case with Evidence

Once you’ve analyzed their report, it’s time to build your own case. Gather the proof needed to justify a higher valuation and paint a complete picture of your car’s true pre-accident worth.

Your evidence file should include:

- Maintenance Records: A detailed service history proves your vehicle was well-cared for, supporting a higher condition rating.

- Receipts for Recent Upgrades: Did you just buy new tires or replace the battery? Provide dated receipts to prove these investments added value.

- Comparable Local Listings: Find at least three to five listings for the exact same year, make, model, and trim for sale in your local area. Use sites like Kelley Blue Book to find values and save listings as PDFs.

By presenting the adjuster with real-world, local market data, you shift the negotiation from their generic report to the reality of what it would cost to replace your vehicle in your area.

For a complete walkthrough, our team created a detailed resource on how to present your case. Learn more by reading our step-by-step guide to disputing a total loss offer. This guide provides templates to help you organize your evidence effectively.

Using a Certified Appraisal to Prove Your Case

So, you’ve gathered your own evidence, but the insurance company still won’t budge. This is when a certified appraisal becomes your most powerful tool. It is a professional, data-driven report from an independent expert that carries serious weight in negotiations.

While your insurer’s valuation came from a generic software program, a certified appraisal is conducted by a real expert. They perform a thorough market analysis to find truly comparable vehicles for sale in your area and make precise adjustments for your car’s specific condition, mileage, and features.

Transforming the Negotiation

This level of detail changes the conversation. The appraisal transforms a frustrating back-and-forth into a data-driven discussion about the true value of a totalled car. An expert report provides the defensible evidence you need to level the playing field.

The auto market is always changing. Rising vehicle prices and high repair costs mean cars are being declared total losses more often. A proper appraisal considers these current market trends, ensuring your valuation is both accurate and timely. You can read more about how market trends are impacting total loss frequency.

A certified appraisal doesn’t just challenge the insurer’s generic report; it replaces it with a specific, evidence-backed valuation of your vehicle. It’s the proof you need to negotiate fairly.

Getting a professional total loss appraisal from a service like SnapClaim provides the impartial, certified data that adjusters must consider. It sends a clear signal that you’ve done your homework and are prepared to stand firm for what you’re owed. This approach strengthens your claim by showing the adjuster exactly where their valuation went wrong.

Understanding Your Options After a Settlement

Once you and the insurance company agree on a fair settlement for the value of a totalled car, you have one last decision to make. This choice determines what happens to the vehicle and how you get paid.

You have two main paths: you can give the car to the insurance company and collect the full settlement, or you can choose to keep the car, a process called “owner retention.”

Surrendering vs. Keeping Your Vehicle

Surrendering the car is the simplest and most common option. You sign the title over to the insurer, and they pay you the full Actual Cash Value (ACV) you agreed on. They then take the car and sell it for its scrap or parts value at auction.

If you choose to keep the car, the insurer will deduct its salvage value from your settlement check. Salvage value is what the insurer estimates they would have received by selling your wrecked car. You get to keep the vehicle but receive a smaller payout.

The Realities of Keeping a Totalled Car

Deciding to keep a totalled vehicle is a major commitment and comes with serious hurdles you should know about.

Here’s what you’re signing up for:

- You’ll Get a Salvage Title: Your state’s DMV will brand the car with a salvage title. This permanently marks it as a total loss and makes it illegal to drive on public roads until it’s repaired and passes a state inspection.

- Repairs Are 100% on You: You are responsible for arranging and paying for all repairs needed to make the car roadworthy again.

- Insurance Is Difficult: Getting full coverage insurance for a car with a “rebuilt” title is challenging. Many carriers refuse to insure previously totalled cars, and those that do often charge very high premiums.

Honestly, this path really only makes sense for skilled mechanics or those who plan to strip the car for parts. Knowing your options is key to making the best financial decision for your situation.

Frequently Asked Questions (FAQ)

Can I negotiate the value of a totalled car with my insurance company?

Yes, absolutely. The insurer’s first offer is a starting point, not the final word. You have the right to review their valuation report, find errors, and present your own evidence (like local comparable vehicle listings or a professional appraisal) to negotiate a higher, more accurate settlement.

What if I owe more on my car loan than the insurance payout?

This situation is known as being “upside-down” on your loan. If the insurance settlement is less than your loan balance, the insurer pays the lender, and you are responsible for paying the remaining difference out of pocket. GAP (Guaranteed Asset Protection) insurance is designed to cover this exact shortfall.

Should I accept the first settlement offer for my totalled car?

It is almost always a good idea to carefully review the first offer before accepting it. Insurers use automated systems that often undervalue vehicles by missing key features, using incorrect comps, or applying unfair condition adjustments. Take the time to review their report and gather your own evidence to ensure you receive the full value of a totalled car.

What is a diminished value claim, and is it related to a total loss?

A diminished value claim applies when your car is repaired after an accident, not when it’s a total loss. It compensates you for the loss in resale value your car suffers simply because it now has an accident history. If your car is repairable, you may be able to file a diminished value claim in addition to getting repairs covered. You can learn more in our guide on what a diminished value claim is.

Get the Compensation You Deserve

Don’t let an automated report decide your car’s worth. A certified appraisal from SnapClaim provides the data-backed proof you need to negotiate a fair insurance total loss payout. Plus, with our Money-Back Guarantee, you can move forward with confidence. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

👉 Get your free totaled loss value estimate today