Getting a car insurance claim denied can be infuriating. You pay your premiums on time, expecting protection, but when you need it most, you hit a wall. It’s a stressful situation on top of an already difficult accident.

But a denial is not the end of the road; it’s the start of a negotiation. Understanding exactly why your insurer said “no” is the first step to building a strong case and getting the fair compensation you deserve.

Why Was Your Car Insurance Claim Denied?

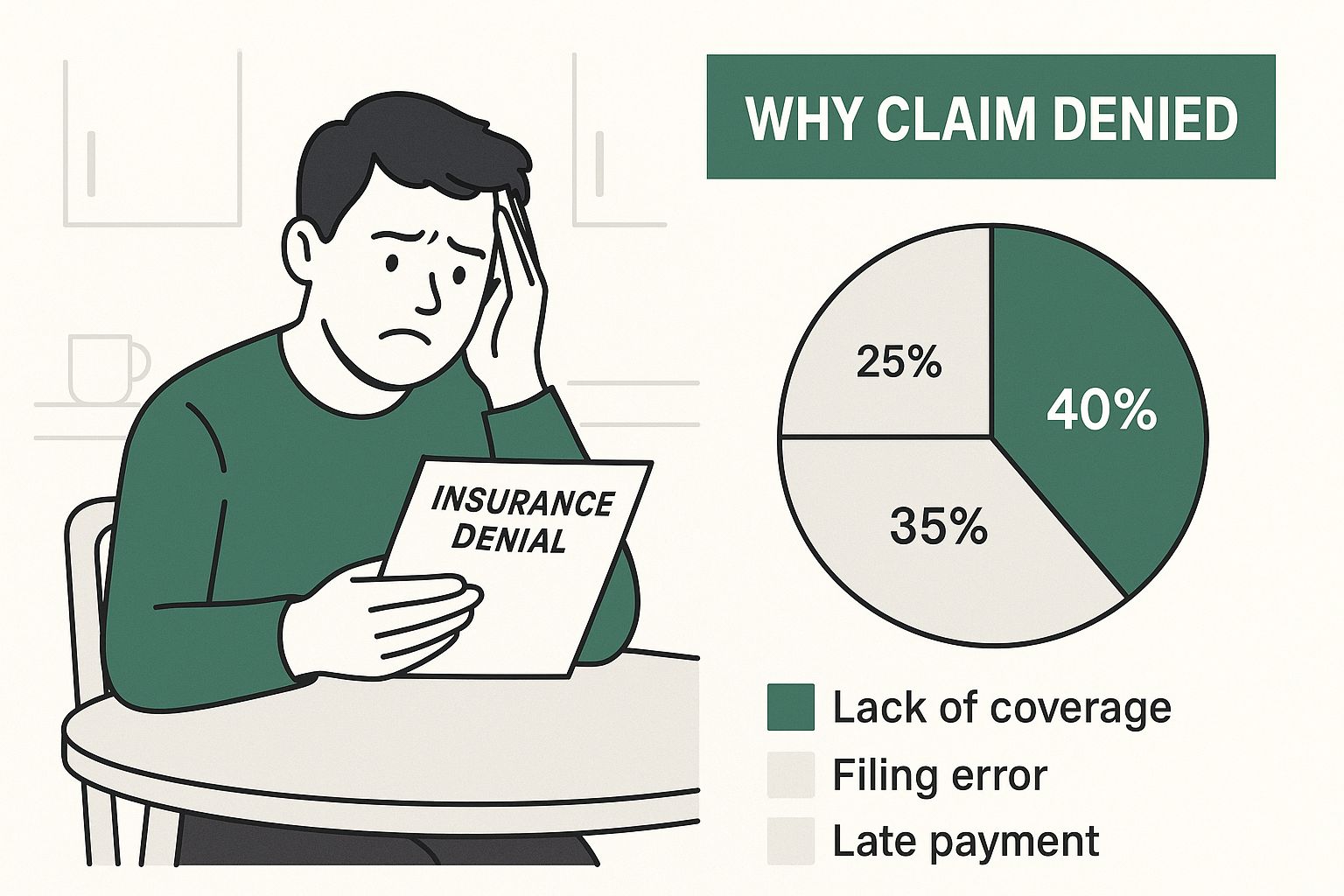

The denial letter you received is designed to be formal and a bit intimidating, often filled with confusing jargon. Don’t let it discourage you. Most denials come down to a few common reasons, from simple paperwork errors to disputes over who was at fault. You can learn about why car insurance claim denied here.

Your job is to read past the formal language and pinpoint the insurer’s specific reason for denial. Once you understand their argument, you can start gathering the evidence needed to overturn it.

Hitting this wall is frustrating, but with the right strategy, you can break through it and secure the payout you’re owed.

Common Reasons for Denial and What to Do Next

Let’s cut through the insurance-speak. The table below translates the most common denial reasons into plain English and gives you an immediate action item for each.

| Insurer’s Stated Reason | What It Really Means | Your Immediate Next Step |

|---|---|---|

| “Policy lapsed prior to the date of loss.” | They believe you missed a payment, causing your coverage to stop. | Find proof of payment (like bank statements) showing your policy was active on the date of the accident. |

| “The loss is excluded under your policy.” | The type of damage isn’t covered by your plan (e.g., you only have liability, not collision coverage). | Review your policy’s “declarations page”—the summary of your coverages—to confirm what’s included. |

| “Failure to provide timely notice of the claim.” | They say you waited too long to report the accident. | Check your policy for the reporting deadline and document any valid reasons for the delay. |

| “Our investigation determined you were at fault.” | They have decided you caused the accident, not their driver. | Gather your evidence: the official police report, photos, witness statements, and any dashcam footage. |

| “The damages claimed are inconsistent with the accident.” | The adjuster thinks some of the damage to your car was pre-existing. | Provide dated photos of your car taken before the accident to prove its prior condition. |

| “Material misrepresentation on the application or claim.” | They suspect you were not completely truthful about the accident or the damages. | Carefully review everything you submitted for accuracy and prepare to provide more detailed proof. |

This list covers many of the reasons a car insurance claim is denied, but the core strategy is always the same: respond with clear, documented facts, not emotion.

Why Insurers Are on High Alert

Insurance companies are on guard against fraud, which is a growing problem. Global losses from insurance fraud now exceed $80 billion annually, and auto insurance fraud is a major contributor.

Because of this, adjusters are trained to look closely at every detail, which can sometimes lead to legitimate claims getting flagged unfairly. You can learn more about how these insurance fraud statistics impact policyholders.

A denial isn’t a personal attack—it’s a business decision. Once you know the insurer’s reason, you can gather the exact evidence needed to challenge their position effectively.

Building an Evidence File to Overturn the Denial

When an insurance company denies your claim, emotions won’t change their mind, but hard facts will. The strength of your appeal depends entirely on the quality of your evidence. Your goal is to build an undeniable case that dismantles their reason for saying no.

Think of yourself as an investigator. You need to assemble a file so thorough that the adjuster has no choice but to reconsider their decision.

The Essentials: Police Report and Photos

The official police report is the foundation of your case. It provides a neutral, third-party account of the accident. If you notice any errors, contact the police department immediately to request a correction.

However, your own photos and videos are often even more powerful.

- Capture the whole story: Take wide shots of the scene, then get close-ups of the damage to all vehicles involved. Don’t forget to photograph skid marks, road debris, or relevant traffic signs.

- Leverage timestamps: Your phone automatically timestamps your photos, proving the damage occurred at the time of the accident and isn’t pre-existing.

- Record a video: A quick video walkthrough can show the flow of traffic or the final positions of the cars in a way that static photos can’t.

These visuals create a clear narrative that is difficult for an insurance company to dispute.

Back It Up With Statements and Detailed Records

An independent witness statement can be a game-changer. If you got contact information at the scene, reach out and ask for a short, written account of what they saw. A neutral perspective adds significant weight to your claim.

It’s also critical to keep a detailed log of every conversation you have with the insurer.

Pro Tip: Start a notebook or digital document immediately. Log the date, time, and name of every person you speak with, along with a summary of the call. This log becomes your best defense if an adjuster later disputes what was said.

The Ultimate Proof: An Independent Appraisal

Here’s where you can gain a significant advantage. The insurance company’s damage estimate is not an objective valuation; it’s a number that serves their financial interests. To fight it, you need your own expert assessment.

A certified car appraisal after an accident is the most powerful tool in your arsenal, especially if you’re disputing a low insurance total loss payout or filing a diminished value claim. A data-backed report from an independent appraiser provides concrete proof that an adjuster cannot simply ignore.

SnapClaim’s certified reports are designed for this exact purpose. They provide a defensible, market-based analysis that pinpoints your vehicle’s true pre-accident value and its loss in value after repairs. This replaces the adjuster’s opinion with verifiable facts, shifting the negotiation power back to you.

Crafting an Appeal Letter That Gets Results

After your car insurance claim is denied, your next move is to write a formal appeal letter. This isn’t just a complaint; it’s a strategic, professional document that forces the insurer to give your case a second, much closer look.

The key is to remain calm and professional. An angry, emotional letter is easy for an adjuster to dismiss. A logical, evidence-based argument is impossible to ignore.

How to Structure Your Appeal Letter

Think of this letter as building a case. It must be clear, persuasive, and easy for a busy claims adjuster to understand.

Start by including your name, policy number, and claim number at the top. Then, open with a direct statement: “I am writing to formally appeal the denial of claim [Your Claim Number], based on your letter dated [Date of Denial Letter].”

This no-nonsense approach immediately sets a serious, professional tone.

Presenting Your Counter-Argument with Evidence

This is where you make your case. Systematically address the insurer’s reasons for denial and dismantle each one with the facts you’ve collected.

- Be Specific: Don’t just say the police report supports you. Instead, write, “The enclosed police report states the other driver was cited for an illegal lane change, as noted on page 2, section 4.”

- Connect Evidence to Your Request: If the insurance total loss payout is the issue, use your appraisal. For example, “Your settlement offer of $15,000 is unacceptable. The enclosed SnapClaim appraisal report establishes the vehicle’s pre-accident actual cash value at $19,500 based on comparable market data.”

- Stay Objective: Let the facts speak for themselves. Leave opinions and emotions out of the letter. The more your appeal reads like a factual report, the more credibility it will have.

By directly linking each of your points to a piece of evidence, you shift the conversation from a battle of opinions to a discussion of facts. For additional help structuring a compelling argument, you can even utilize AI to draft effective demand letters.

Finally, send your appeal letter via certified mail with a return receipt requested. This provides undeniable proof of when the insurer received it, which is crucial for holding them accountable.

Negotiating with the Adjuster from a Position of Strength

Once your appeal is submitted, the real conversation begins. Many people feel nervous at this stage, but remember: you have built a powerful case backed by solid evidence. You are no longer just making a request; you are presenting a factual argument from a position of control.

The goal isn’t to start a fight. Approach it as a structured business negotiation. The adjuster is a trained professional whose job is to resolve claims while saving their company money. Your job is to be more prepared and persistent.

Know Your Numbers Before You Talk

Before you pick up the phone, you must know your numbers cold. The most important figure is your target settlement amount—the specific, evidence-backed number you are willing to accept.

Your independent appraisal report is the source of this number. Whether you’re fighting a low insurance total loss payout or an inadequate repair estimate, your report provides the market data to justify your figure.

For example, if the insurer offered $18,000 for your totaled car, but your SnapClaim report establishes its true cash value at $22,500 based on local comparable sales, then $22,500 is your target. This isn’t a starting point for haggling; it’s the factual value you are owed.

Having a clear, evidence-based number keeps you focused and prevents you from being swayed by the adjuster’s tactics.

Presenting Your Case Confidently

When you speak with the adjuster, your tone should be calm, firm, and professional. You are not asking for a favor; you are discussing the fulfillment of a contract.

Lead the conversation by stating your position clearly. You might say, “I’ve reviewed your initial offer, and it doesn’t align with the vehicle’s market value. My documentation, including a certified appraisal, shows the actual loss is $22,500.”

- Stick to the Facts: If the adjuster mentions their “internal valuation methods,” gently guide the conversation back to your evidence.

- Reference Your Documents: Constantly refer to your appraisal, the police report, and repair estimates. This shows you are organized and serious.

- Take Detailed Notes: As with every call, log the date, time, name of the person you spoke with, and a summary of what was discussed.

Your confidence will come from your preparation. When your evidence is solid, you can push back against lowball offers without becoming emotional.

Countering Common Adjuster Tactics

Adjusters use a playbook of strategies to minimize payouts. Knowing them helps you counter them effectively.

- The Delay Game: They might take days to return calls, hoping you’ll get frustrated and accept a low offer. Your move: Be politely persistent with follow-up emails to create a paper trail.

- The “Our System Says” Argument: They’ll claim their software generated the value. Your move: Calmly remind them that their internal system is not a substitute for real-world market data, which your independent appraisal provides.

- The Quick Low Offer: They might offer a slightly higher, but still low, settlement to make you feel like you’ve won. Your move: Thank them for the revised offer, but state that it still falls short of what the evidence supports.

Navigating the claims process, especially when a diminished value claim is involved, can be complex. Our guide on how to file a diminished value claim provides a step-by-step breakdown that perfectly complements your negotiation strategy.

What to Do When the Insurer Still Says No

You’ve done everything right: you built a solid case, submitted a professional appeal, and negotiated calmly. But what if the insurance company still won’t offer a fair settlement? It’s frustrating, but you still have powerful options.

When your appeal on a car insurance claim denied hits a dead end, it’s time to escalate. The insurance company is not the final authority on your claim.

File a Complaint with Your State’s Department of Insurance

Every state has a Department of Insurance (DOI), a government agency that regulates insurance companies and protects consumers. Filing an official complaint is a significant step that often forces a senior-level review of your case.

When you file a DOI complaint:

- An official inquiry is launched, requiring the insurer to provide a formal written response.

- An investigator reviews whether the company followed state laws and its own policy rules.

- The pressure of a government investigation often brings the insurer back to the negotiating table.

This service is free, and you can usually start the process on your state DOI’s website.

Know When It’s Time to Hire an Attorney

If the insurer’s actions feel like more than just a disagreement, you may be dealing with “bad faith.” This legal term applies when an insurance company fails to uphold its contractual obligations without a reasonable basis.

Consider talking to an attorney if you experience:

- Refusal to provide a reason for denial in writing.

- Unreasonable delays in processing your claim.

- Misrepresenting the language in your policy to avoid paying.

- Failing to conduct a proper and thorough investigation.

A good attorney can take over communications and file a lawsuit if necessary. This is especially true for complex situations like a disputed insurance total loss payout. Our step-by-step guide to disputing a total loss offer can provide more context.

Feeling let down by an insurer is a common experience. A J.D. Power U.S. Auto Insurance Study revealed that 38% of policyholders are dissatisfied with their insurance companies. You can read the full study on insurer performance and see you are not alone in this fight.

Frequently Asked Questions

Can I appeal a denied claim if the accident was my fault?

Yes, absolutely. If you have collision coverage, it is designed to pay for your vehicle’s repairs regardless of who was at fault. A denial in this case is likely due to another reason, such as a policy exclusion, which you have every right to appeal.

How long do I have to file an appeal?

The timeframe for an appeal varies by state and insurer. Your denial letter should state the deadline. If it doesn’t, contact your insurance company in writing immediately to ask for that information. Act quickly to ensure you don’t miss your window to appeal.

Will appealing my claim make my insurance premium go up?

The act of appealing a denial should not affect your rates. A premium increase is typically triggered by the claim itself, especially if you were found to be at-fault in the accident. Fighting for the fair payout you are contractually owed is your right as a policyholder.

What if the insurance company’s offer is still too low after my appeal?

You are never obligated to accept an unfair offer. If the insurer’s revised settlement for an insurance total loss payout or repair is still inadequate, it’s time to present your strongest evidence. A certified, independent appraisal from a service like SnapClaim provides the data-backed proof you need to negotiate fairly. If they still refuse to budge, your next steps are filing a complaint with your state’s Department of Insurance or consulting with an attorney.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

A certified appraisal report from SnapClaim provides the proof you need to negotiate a fair settlement. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

Ready to prove your claim? Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

👉 find a diminished value appraiser near you