Has your insurance company just told you your car is a total loss? Most people picture a crumpled wreck, but a “total loss” is a financial decision, not a judgment on how damaged your car looks. It simply means the insurer has determined it’s cheaper to pay you for your car’s value than to repair it.

Understanding how they reach this conclusion is the first step toward ensuring you get a fair settlement. This guide will walk you through the process in clear, simple terms so you can navigate your claim with confidence.

What It Means When a Car Is a Total Loss

Hearing the words “total loss” can be stressful, but for the insurance company, it’s a straightforward business calculation. At its core, an insurer compares two key numbers: the estimated cost of repairs and your car’s Actual Cash Value (ACV), which is what your car was worth right before the accident.

If the repair bill gets too close to your car’s value, the insurer will declare it a total loss car. This decision is guided by a specific rule set by your state.

The Financial Tipping Point: Total Loss Threshold

Every state has a guideline called the Total Loss Threshold (TLT), which is a percentage of your car’s ACV. If the repair costs exceed this percentage, the vehicle is automatically totaled.

For example, if you live in a state with a 75% threshold and your car was worth $20,000, it will be declared a total loss if the repair estimate is more than $15,000. Some states use a “Total Loss Formula” instead, where the car is totaled if the repair cost plus its salvage value (what the wrecked car can be sold for) exceeds its ACV.

The key takeaway: A total loss isn’t about whether your car can be repaired. It’s about when repairs stop making financial sense for the insurance company.

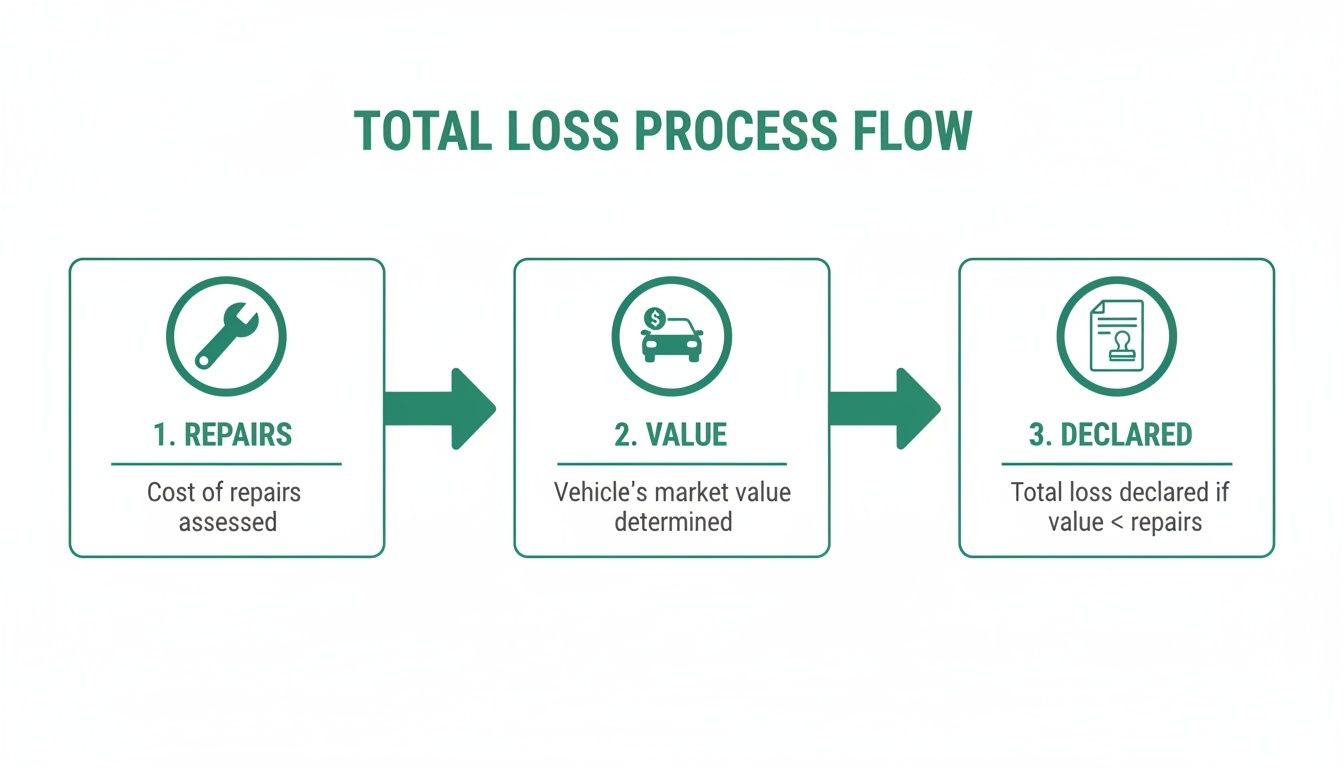

To make this decision, an adjuster does three things:

- Estimates Repair Costs: They calculate the total cost of parts and labor, from fixing a bent frame to recalibrating safety sensors.

- Determines the Actual Cash Value (ACV): They research what a vehicle just like yours—same make, model, year, mileage, and condition—was selling for in your local area before the accident.

- Calculates the Salvage Value: They estimate what the damaged car could be sold for at a salvage auction.

Once these numbers are plugged into your state’s formula, the decision is made. Knowing these terms is crucial because they form the basis of your settlement offer.

Key Terms in a Total Loss Claim

| Term | Simple Explanation | Why It Matters to You |

|---|---|---|

| Actual Cash Value (ACV) | What your car was worth the moment before the accident. | This is the starting number for your settlement. A low ACV means a low insurance total loss payout. |

| Total Loss Threshold (TLT) | A percentage set by your state. If repairs exceed this % of the ACV, it’s a total loss. | This rule determines if your car is totaled, not how much you get paid. |

| Salvage Value | The amount an insurer can get by selling your wrecked car for parts or scrap. | This value is subtracted from your payout if you decide to keep the car. |

| Total Loss Formula (TLF) | An alternative to the TLT. Car is totaled if (Repairs + Salvage) > ACV. | Another state-specific rule that forces the insurer’s hand. |

Understanding this vocabulary empowers you to ask the right questions and challenge the insurer’s numbers if they don’t seem right. The ACV is almost always the point of negotiation, and it’s where having your own proof of value makes all the difference. You can learn more about state-specific laws on our site to see how these rules apply in your area.

How Insurance Companies Calculate a Total Loss Payout

When an insurer declares your vehicle a total loss car, they follow a methodical process to determine its pre-accident worth. Understanding how they do this is key to ensuring you receive a fair settlement.

The entire calculation centers on one core concept: Actual Cash Value (ACV). This isn’t what you paid for the car or what a new one costs. ACV represents the fair market price for a vehicle just like yours—same year, make, model, and condition—in your local area.

Determining the Actual Cash Value

To determine your car’s ACV, the insurance adjuster uses a third-party valuation service to analyze recent sales data for “comparable” vehicles. It’s similar to how a real estate agent prices a house by looking at recent sales of similar homes nearby.

They look for cars that are a close match to yours and then make adjustments.

- Positive Adjustments: Features like a premium sound system, new tires, a sunroof, or exceptionally low mileage can increase the ACV.

- Negative Adjustments: Existing scratches, worn tires, or high mileage will decrease the ACV.

The final number they calculate becomes their official assessment of your car’s pre-accident value. You can get a better feel for this crucial figure with our guide on calculating a car’s Actual Cash Value.

The Total Loss Threshold and Final Calculation

Once the ACV is set, the insurer compares it to the estimated repair costs using your state’s Total Loss Threshold (TLT). If the repair bill exceeds that percentage of the ACV, the car is officially totaled.

For example, many states use a 75% threshold. If your car’s ACV is $20,000, it will be declared a total loss if the repair estimate is more than $15,000. This flowchart breaks down how repair costs and market value lead to the final total loss declaration.

As you can see, it boils down to a simple financial equation: do the repairs cost more than the vehicle is worth, according to state rules?

Let’s walk through a quick example to see how these pieces fit together.

Example Calculation in Action

Imagine your sedan is in a state with a 75% Total Loss Threshold.

- Actual Cash Value (ACV): The insurer determines your car’s pre-accident value was $18,000.

- Repair Estimate: A body shop quotes $14,500 to fix extensive damage.

- Threshold Calculation: The state’s 75% threshold on an $18,000 car is $13,500 ($18,000 x 0.75).

- The Decision: Because the $14,500 repair cost is higher than the $13,500 threshold, the insurance company declares the car a total loss.

What Your Final Payout Includes

The settlement offer for your total loss car starts with the ACV, but that shouldn’t be the only number. Your final payout should also include other costs as required by your state.

Here’s what you should typically see in the final offer:

- The vehicle’s ACV: This is the main part of your settlement.

- Sales Tax: Most states require the insurer to add money to cover the sales tax you’ll pay on a replacement car.

- Title and Registration Fees: Many states also make insurers cover the fees for titling and registering your next vehicle.

If you were at fault and are using your own collision coverage, your deductible will be subtracted from the total. So, if your settlement is $18,000 with a $500 deductible, your final check will be $17,500.

Why So Many Cars Are Being Declared a Total Loss

If it seems like more cars are being totaled after accidents, you’re right. This trend isn’t because accidents are more severe; it’s driven by massive shifts in vehicle technology and the economics of modern repairs.

When repair costs get too close to a car’s value, the insurer cuts its losses. With today’s technology, that tipping point is reached much faster.

The High Cost of High-Tech Repairs

The biggest reason for the rise in total loss claims is the complexity of modern vehicles. Cars are no longer just mechanical—they are powerful computers on wheels, filled with expensive electronics.

Even a minor fender-bender can lead to a surprisingly high repair bill. Today’s bumpers are packed with critical safety technology:

- Sensors: Ultrasonic dots that assist with parking.

- Cameras: Lenses providing 360-degree and backup views.

- Radar Units: The brains behind Advanced Driver-Assistance Systems (ADAS) like adaptive cruise control and automatic emergency braking.

Fixing the plastic bumper is the easy part. After a new bumper is installed, every sensor and camera must be recalibrated with precision. If a sensor is off by even a millimeter, a crucial safety feature could fail. This specialized work sends repair estimates soaring.

The Double Whammy: Labor and Parts Costs

Two other economic forces are at play. First, the cost of skilled labor has risen sharply. Technicians who work on these high-tech systems require specialized training, and their expertise is expensive.

Second, global supply chain issues persist, making it difficult to find the right parts. When a component is on backorder, its price can skyrocket, and an insurer may find it more cost-effective to total the vehicle than to pay for a rental car for weeks.

It’s a perfect storm: sophisticated technology, high-priced labor, and scarce parts. This has changed the math for insurers, making them far more likely to declare a car a total loss.

The numbers confirm this trend. Recent data shows that nearly one in four crashed vehicles is now being totaled. Industry reports point to a jump from 22.1% to 22.8% in a single year, the highest rate ever recorded. You can discover more insights about these rising repair costs and their impact on the insurance industry.

Your Options After a Total Loss Declaration

Once an insurance company declares your vehicle a total loss, you have a decision to make. Don’t let the adjuster rush you. The path you choose will impact your finances, so it’s important to understand your two main options.

Most people take the simplest route: accept the settlement, sign over the title, and let the insurance company take the damaged vehicle. But there is another option that comes with more responsibility.

Option 1: Accept the Payout and Surrender the Vehicle

This is the most common choice. Once you and the insurer agree on the final settlement amount (ACV plus taxes and fees), the process is straightforward.

- You sign the title over to the insurance company.

- The insurer pays you (and your lender, if you have a loan).

- They tow the car away to be sold at a salvage auction.

This option provides a clean resolution, giving you the cash to shop for a new vehicle and avoid the hassle of dealing with a wrecked car.

Option 2: Retain the Vehicle and Receive a Reduced Payout

In most states, you have the right to keep your total loss car. This is often called “owner retention.” If you choose this option, the insurance company pays you the agreed-upon ACV, minus the vehicle’s salvage value (the amount they would have received from selling it at auction).

For example, if your car’s ACV is $20,000 and its salvage value is $4,000, your payout would be $16,000, and you would keep the damaged car.

Important Consideration: If you keep your car, the DMV will issue it a salvage title. This permanently brands the vehicle, hurting its future resale value and making it difficult and expensive to insure.

Before you can legally drive it again, you must have it repaired to meet state safety standards and pass a special inspection to receive a “rebuilt” title. This process is costly and complicated. For a deeper look, our Total Loss guides can provide more detail.

Comparing Your Total Loss Options

The right choice depends on your financial situation and long-term goals. This table breaks down the key differences between your two main options.

| Option | What Happens | Pros | Cons |

|---|---|---|---|

| Accept Payout & Surrender Vehicle | You get the full ACV settlement and the insurer takes the car. | Simple, fast, and provides a clean break. You get the maximum cash payout. | You lose your vehicle and must find a replacement. |

| Retain Vehicle & Get Reduced Payout | You keep the damaged car and receive the ACV minus its salvage value. | You can repair the car yourself (if you have the skills) or sell it for parts. | Complex process with a salvage title, repair costs, and lower resale value. The payout is smaller. |

For most drivers, accepting the full payout is the most practical option. However, if you have a solid plan for the vehicle, owner retention might be worth considering.

How to Dispute a Low Settlement Offer for Your Total Loss Car

Receiving a low settlement offer for your total loss car can be frustrating. However, the insurer’s first offer is just a starting point, not the final word. You have the right to challenge their valuation and negotiate for a fair payout.

Being prepared with clear, factual evidence is the key to a successful negotiation. It can make a significant difference in your final settlement.

Scrutinize the Insurer’s Valuation Report

First, ask for a complete copy of the insurance company’s valuation report. This document, often from a third-party service like CCC ONE or Mitchell, details how they arrived at their offer. Look for common mistakes.

Here’s what to check for:

- Incorrect Vehicle Trim and Options: Did they list your car as a base model when it was a premium edition? Missing features like a sunroof, premium audio, or advanced safety packages can reduce the value by thousands.

- Unfair Condition Rating: Adjusters may downgrade a vehicle’s condition for normal wear and tear. If your car was in “Excellent” condition but rated as “Average,” you should challenge it.

- Poor “Comparable” Vehicles: The report will list “comps” used to determine value. Look for vehicles with higher mileage, fewer options, or from outside your local market, as these can lower the average value.

Gather Your Own Evidence

After identifying flaws in their report, build your own case to prove your car was worth more. A strong counter-offer is built on facts, not feelings.

A strong counter-offer isn’t based on what you feel your car was worth. It’s built on clear, factual evidence that an adjuster can’t easily dismiss.

Your evidence file should include:

- Maintenance and Repair Records: Show the car was well-cared-for with receipts for oil changes, new tires, and other major services.

- Proof of Recent Upgrades: Provide receipts for recent purchases like new tires, brakes, or a battery to show they added value.

- Your Own Market Research: Find online listings for cars identical to yours (same year, make, model, trim, and similar mileage) from local dealerships. Use sites like Kelley Blue Book or Edmunds and save screenshots as proof of your car’s market value.

The Power of an Independent Appraisal

Presenting your own research is a good start, but the most effective tool for fighting a low offer is a certified, independent appraisal. While your evidence is helpful, an insurer may dismiss it as biased. A professional report from a trusted third party like SnapClaim provides the proof you need to negotiate fairly.

Our certified appraisers use industry-standard methods to calculate the true fair market value of your total loss car. This report is a powerful negotiation tool that is difficult for an insurer to ignore. Learn more in our guide on a step-by-step approach to disputing a total loss offer.

Once you and the insurer agree on a number, you’ll sign a legally binding document called a settlement release agreement.

Arm Yourself with a Certified SnapClaim Appraisal

Negotiating with an insurance company over your total loss car can feel overwhelming. They come prepared with their own valuation reports and data that often favor their bottom line, leaving you at a disadvantage.

SnapClaim levels the playing field by providing the objective, data-driven proof you need to challenge a low offer and secure the compensation you deserve.

The insurer’s valuation is often generated by an automated system that may use outdated data or miss your vehicle’s unique features and excellent condition. A certified SnapClaim appraisal is different. It’s a court-ready, meticulously researched report that pinpoints the true Fair Market Value of your vehicle in your local market.

How a SnapClaim Report Gives You Real Leverage

Our reports are built on a certified methodology that stands up to scrutiny from insurance adjusters. We analyze current, local market data, account for every factory option, and factor in your vehicle’s specific history.

This gives you concrete evidence to challenge the insurer’s assessment by identifying common mistakes such as:

- An incorrect vehicle condition rating or missing options.

- Poorly chosen “comparable” vehicles that lower your car’s value.

- A failure to account for local market demand for your make and model.

If you’ve received a settlement offer that feels too low, learning how to dispute an insurance claim is your first step. Our report provides the powerful evidence needed to support your case.

A Risk-Free Way to a Fairer Payout

We are so confident in the accuracy of our reports that we back them with a straightforward guarantee. You shouldn’t have to risk your money to get the fair payout you deserve.

Our Money-Back Guarantee: If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

This makes our service a risk-free decision. You either receive a significantly higher settlement or you get your money back. We are your dedicated partner, committed to ensuring you get every dollar you’re owed for your total loss car.

Ready to fight back? Explore our total loss appraisal services and see how we can strengthen your claim today.

FAQ: Common Total Loss Car Questions

When your car is totaled, it’s easy to feel overwhelmed by questions and insurance jargon. We’ve helped thousands of vehicle owners navigate this process and have compiled answers to the most common concerns.

Can I keep my car if it’s declared a total loss?

Yes, in most states, you can choose to “retain salvage.” If you do, the insurance company will pay you the car’s Actual Cash Value (ACV) minus what they would have received for it at a salvage auction. Be aware that the vehicle will be issued a salvage title, which can make it difficult to insure or sell in the future.

What if I owe more on my loan than the car is worth?

This is a common and difficult situation. The insurance company typically sends the settlement check directly to your lender. If the payout doesn’t cover your entire loan balance, you are responsible for paying the difference. This is where GAP (Guaranteed Asset Protection) insurance is crucial, as it covers the “gap” between the insurance total loss payout and what you still owe.

How long does a total loss claim take?

While every claim is different, most total loss settlements are resolved within about 30 days. This timeline includes the initial inspection, valuation, negotiations, and final payment. Disputing a low offer can extend this period, but fighting for fair compensation is often worth the extra time.

Do I have to accept the insurance company’s first offer?

No. The insurer’s first offer is a starting point for negotiations, not the final word. You have the right to challenge their valuation if you believe it doesn’t reflect your vehicle’s true market value. To do so effectively, you need to provide proof. A certified, independent appraisal from SnapClaim gives you the hard data needed to level the playing field and demand a fair settlement.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your Total loss (Fair Market Value) Appraisal Today