If you’ve been in a car accident, you’ve likely heard the term Actual Cash Value (ACV) from your insurance company. This single number is the most important factor in your claim, determining the payout you’ll receive if your vehicle is repaired or declared a total loss. Understanding what it is and how it’s calculated is your first step toward getting fair compensation.

But here’s what insurers don’t always make clear: ACV isn’t what you paid for the car or what a new one costs. It’s the fair market value of your specific vehicle the moment before the crash happened. An inaccurate ACV almost always leads to a lowball settlement offer.

Why Your Car’s Actual Cash Value Is So Important

Knowing your car’s true ACV is the most critical step in any insurance claim. The adjuster will use their own auto actual cash value calculator to determine a figure, but their goal is often to minimize the company’s payout. This means the number they present may not reflect your vehicle’s real worth.

If you accept their initial offer without question, you could be leaving thousands of dollars on the table. A fair valuation is the foundation for everything that follows.

The Foundation of Your Claim

Think of the ACV as the starting line for the entire negotiation. Everything that happens next depends on it.

- Total Loss Payouts: If your car is declared a total loss, the ACV is the amount the insurer will offer you, minus your deductible. A lowball ACV means a smaller check.

- Diminished Value Claims: When your car is repaired, the pre-accident ACV is the baseline used to calculate its loss in resale value. An inaccurate starting point guarantees an unfair diminished value settlement.

- Repair Decisions: The insurance company compares the estimated repair costs to the ACV. If repairs exceed a certain threshold (usually 75-80% of the ACV), they will declare the vehicle a total loss.

Details matter. Your vehicle’s condition, maintenance history, and upgrades directly impact its real-world value. For instance, many owners wonder if Is a ceramic coating worth it for protection and value retention. This is a perfect example of a detail an insurer’s generic calculator might completely miss.

You can get a deeper look at how fair market value is determined in our complete guide on understanding Actual Cash Value. Once you know how ACV is really calculated, you can spot a low offer and negotiate with credible, data-backed proof.

Understanding the Auto Actual Cash Value Calculator

An auto actual cash value calculator functions like a real estate appraiser for your car. It doesn’t just guess a number—it systematically analyzes specific data points to determine your vehicle’s fair market value the moment before it was damaged.

To arrive at an accurate figure, these calculators look beyond the basics. While they start with core vehicle information, the final valuation is shaped by subtle factors that reflect its real-world condition and desirability in the current market.

Core Vehicle Information

This is the starting point for any valuation and sets the baseline value before any adjustments. The most crucial inputs are straightforward:

- Make, Model, and Year: This pinpoints the exact vehicle.

- Mileage: Lower mileage generally means a higher value, as it suggests less wear and tear.

- Trim Level and Options: A fully-loaded trim with a premium sound system, sunroof, and modern safety features is worth significantly more than a base model.

Condition and Regional Adjustments

Once the baseline is set, the calculator digs deeper. This is where an insurer’s valuation often diverges from reality, as they may apply aggressive deductions or ignore positive factors.

The most important elements here are the vehicle’s overall condition and its location. A car from a snowy, salt-covered northern state will be valued differently than the same car from a dry, sunny climate where rust isn’t a concern. Likewise, a well-maintained vehicle with complete service records will hold its value far better than one with a questionable history.

Want to see how these factors work together? You can get a quick idea with our free auto actual cash value calculator.

Key Factors That Influence Your Car’s Actual Cash Value

The table below shows the most important inputs for an ACV calculator and explains how each one impacts the final number.

| Factor | What It Means for Your Car | How It Impacts Your Car’s ACV |

|---|---|---|

| Mileage | The total distance the vehicle has been driven. | Lower mileage typically increases value; higher mileage decreases it due to expected wear. |

| Condition | The vehicle’s physical and mechanical state (e.g., excellent, fair, poor). | A car in pristine condition is worth significantly more than one with dings, rust, or mechanical issues. |

| Options/Trim | The specific package of features included with the vehicle. | Premium trims, sunroofs, leather seats, and advanced tech all add to the car’s baseline value. |

| Location | The geographic region where the car is registered. | Demand for certain vehicles (like 4x4s in snowy areas) and local climate (rust vs. sun damage) create regional price differences. |

| Accident History | Previous collision records reported on services like Carfax. | Even with quality repairs, a documented accident history almost always lowers a car’s market value. |

| Service Records | A documented history of regular maintenance and repairs. | A complete service history proves the car was well-cared-for and can significantly boost its value. |

As you can see, it’s the combination of these details—not just the make and model—that paints the full picture of your car’s true worth.

The Power of Comparable Sales Data

Now for the most important—and often disputed—part of the equation. An accurate ACV must be based on what similar vehicles (“comparables” or “comps”) have actually sold for in your local area recently. The catch is that the source of that sales data is everything.

Insurance companies often pull data from sources that benefit them, like wholesale dealer auctions where prices are naturally lower. A fair valuation should reflect private-party or retail sales prices—what it would actually cost you to buy a similar car today.

Because different tools use different baseline prices (trade, private-party, dealer retail) and different depreciation multipliers, two ACV calculators applied to the same car could easily vary by 5%–15% of the vehicle’s value.

This gap is why an insurer’s first offer is rarely their best offer. Leading consumer guides like Kelley Blue Book make it clear that ACV should reflect current market worth, factoring in depreciation and condition based on live market data. You can discover insights on how KBB defines ACV to see how the pros approach it. This is why challenging an insurer’s valuation with independent, market-backed data is so effective.

How Insurers Can Undervalue Your Claim

Insurance companies are businesses, and their goal is to minimize payouts. When they value your vehicle, the adjuster uses an auto actual cash value calculator that is often loaded with data and assumptions designed to justify the lowest possible settlement. Knowing their playbook is the first step to protecting yourself from a lowball offer.

The adjuster’s valuation process is often a black box. They might give you a final number without showing their work, hoping you’ll accept it and move on. By understanding their common tactics, you can spot how they undervalue your car.

Common Tactics Insurers Use

Insurers have a few go-to strategies for driving down a vehicle’s ACV. These almost always involve cherry-picking data or making unfair assumptions.

- Using Outdated Market Data: The used car market changes quickly. An insurer might use sales data from months ago when prices were lower, ignoring current demand.

- Cherry-Picking Comparables: This is a classic tactic. To value your fully-loaded, low-mileage SUV, they might pull “comparable” vehicles that are actually base models, have higher mileage, or have prior accident histories.

- Applying Excessive Deductions: Insurers often penalize you for normal wear and tear. They may apply harsh deductions for minor, pre-existing scratches or dings that would barely affect a real-world private sale.

- Ignoring Upgrades and Maintenance: Did you recently install new tires or keep detailed service records? Their calculator will likely ignore these value-adding factors unless you provide proof and insist they are included.

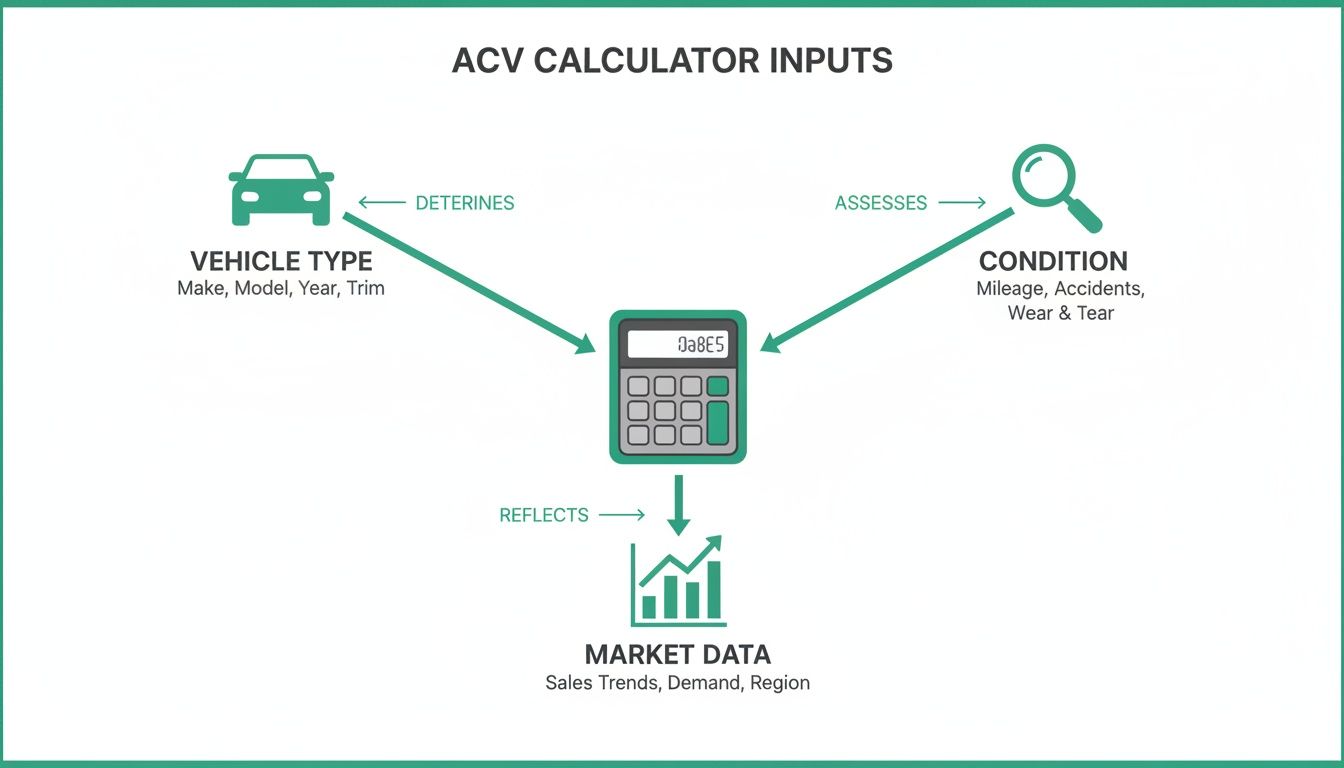

This diagram breaks down the key inputs for any ACV calculation. It’s a good visual of where an insurer’s version of reality can drift from the actual facts.

As you can see, that final number is completely dependent on the quality of the data they plug in for the vehicle, its condition, and the market.

A Real-World Scenario

Let’s say you own a well-maintained 2021 SUV with premium features. Before the accident, it was worth around $30,000. The insurance company offers you just $25,500. So, what happened to the other $4,500?

The adjuster likely pulled a report comparing your top-trim SUV to base models sold at wholesale auctions three months ago. On top of that, they slapped on a $1,000 deduction for “prior wear” because of a few scuffs on the bumper. Just like that, they’ve devalued your vehicle from multiple angles.

This happens every day. Without seeing a detailed breakdown, you’re left in the dark and pressured to accept a settlement that doesn’t make you whole. This is why an independent, data-driven appraisal is so important for negotiating a fair insurance total loss payout.

Understanding Diminished Value After an Accident

Not every accident results in a total loss. But even with flawless repairs, your vehicle now has an accident history. That history permanently reduces its market value, and this financial loss is known as Diminished Value. It’s the difference in what someone would pay for your car now versus what they would have paid before the accident.

Think about it from a buyer’s perspective. If you’re choosing between two identical used cars, but one has a collision repair on its record, you’d expect to pay less for that one. That price difference is its diminished value, and you have a right to recover it from the at-fault party’s insurance.

Connecting ACV to Diminished Value

Your car’s pre-accident Actual Cash Value is the foundation of any diminished value claim. Before you can determine how much value was lost, you must first prove what the vehicle was worth a moment before the crash. An accurate ACV is the bedrock of a fair settlement.

Insurance companies often use their own formulas to calculate this loss. You might hear them mention the “17c formula,” which is widely criticized for being simplistic and heavily favoring the insurer.

A common diminished-value formula starts with the pre-accident value (say, $40,000), applies a 10% cap to get a base of $4,000, then reduces it further with damage and mileage penalties. You can get a closer look at how post-accident ACV adjustments are modeled on Mighty.com.

This shows why a higher starting ACV can directly lead to a larger diminished value payout, even after the insurance adjuster applies their limiting factors.

A Clear Calculation Example

Let’s walk through a simple diminished value scenario to see just how critical the pre-accident ACV is.

- Step 1: Establish Pre-Accident ACV: An independent appraisal determines your vehicle’s fair market value was $35,000 right before the collision.

- Step 2: Apply a Base Cap: Using the industry-standard 10% cap as a starting point, the maximum potential diminished value is $3,500.

- Step 3: Adjust for Damage Severity: The accident caused moderate structural damage, so a damage multiplier of 0.75 is applied ($3,500 x 0.75 = $2,625).

- Step 4: Adjust for Mileage: Your vehicle has average mileage, so a mileage multiplier of 0.8 is applied ($2,625 x 0.8 = $2,100).

In this case, your recoverable diminished value is $2,100.

Now, watch what happens if the insurer had lowballed your car’s initial ACV at just $30,000. The same formula would spit out a final claim amount of only $1,800. This $300 difference is why fighting for an accurate pre-accident value is non-negotiable.

Our Diminished Value and Total Loss guides offer a much deeper dive into navigating these specific types of claims.

Why Live Market Data Is Crucial for Accurate Valuations

A car’s value isn’t a fixed number found in an old book. It’s a dynamic figure that changes with the market every day. Static depreciation charts are relics; a modern, accurate auto actual cash value calculator must be powered by live, up-to-the-minute market data.

Your vehicle’s worth can shift dramatically in just a few months. Supply chain issues, gas price fluctuations, or a popular new model release can cause values for specific cars to surge or plummet. An insurer using data from six months ago isn’t giving you a fair picture of what your car is worth today.

The Problem with Outdated Valuations

Relying on old information is a classic tactic insurers use to undervalue claims. They might provide a valuation report, like one from CCC Intelligent Solutions, that pulls from a database of historical sales that don’t reflect current demand. Our deep dive on the CCC ONE market valuation report explains how these systems can be stacked against you.

When the insurer’s calculator ignores what’s happening in the real world, you are the one who loses. Their outdated figures simply can’t stand up to a valuation built on what actual buyers are paying for comparable vehicles right now.

The Power of Real-Time Analysis

Using a valuation method tied to live market data provides a true, defensible assessment of your car’s actual worth. Market-driven calculators aggregate real transaction data to track value trends over time, and the results can be surprising.

For instance, some models might only hold 28-31% of their original price after three years, while others retain much more—a critical detail that static tables completely miss.

Because ACV is a snapshot of what a willing buyer would pay at a specific point in time, tools that integrate real-time sales data provide the most market-reflective estimates.

But the most accurate valuation isn’t just about broad market trends; it’s also about your specific car’s condition. Incorporating data from systems that offer a detailed look at your vehicle’s condition, like a GPS car tracker monitoring vehicle health, can provide crucial data points for a precise Actual Cash Value. This level of detail gives you a powerful advantage when you need to challenge an insurer’s lowball offer.

How a Certified Appraisal Helps You Get Fair Compensation

So, you see how easily an insurer can undervalue your claim. What’s the solution? While free online estimators are great for a quick check, they don’t carry any weight when you’re challenging an adjuster’s lowball offer. The single most effective tool you have is a certified, independent appraisal.

Think of it this way: the insurance company’s valuation is their opinion, backed by data that serves their bottom line. A certified appraisal is an expert’s unbiased opinion backed by hard market evidence that can stand up to scrutiny. It’s not just another number; it’s defensible proof of your vehicle’s actual worth.

The Power of Data-Driven Evidence

A SnapClaim certified appraisal report goes far beyond a generic auto actual cash value calculator. Our appraisers perform a detailed analysis of your specific vehicle and what it’s selling for in your local market. We arm you with the proof you need to negotiate from a position of strength.

Our reports strengthen your claim by:

- Analyzing Live Market Data: We pull real-time sales data for comparable vehicles in your area—not stale, irrelevant auction results from months ago.

- Accounting for All Value Factors: We meticulously document your vehicle’s specific trim, optional features, and overall condition to build a true, accurate value.

- Creating a Defensible Report: You receive a court-ready document that lays out our methodology and data in plain English, making it nearly impossible for an adjuster to dismiss.

This process systematically replaces the insurer’s vague assumptions with objective, verifiable facts, supporting your case with certified data.

An Investment in Your Claim

It’s a mistake to see a professional appraisal as an expense. It’s an investment in getting a fair insurance total loss payout or diminished value claim. The goal is always to recover far more than the cost of the report itself. At SnapClaim, we stand by that promise.

“If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.”

Our Money-Back Guarantee makes this a completely risk-free decision. You get an expert in your corner with the evidence needed to build a rock-solid case for fair compensation. According to the National Highway Traffic Safety Administration (NHTSA), motor vehicle crashes represent staggering financial costs, and a proper appraisal ensures you recover your fair share of that loss.

Frequently Asked Questions About Using an Auto Actual Cash Value Calculator

Dealing with an insurance claim can feel overwhelming, but understanding the key terms puts you back in the driver’s seat. Here are straightforward answers to common questions about your vehicle’s value.

Can I dispute the insurance company’s ACV offer?

Yes, absolutely. You are never obligated to accept an insurer’s first offer, especially if you believe it’s too low. The key to a successful dispute is to counter their numbers with your own objective, third-party evidence. A certified appraisal report from an independent expert is your best tool, providing the proof you need to negotiate fairly.

Is Kelley Blue Book value the same as Actual Cash Value?

Not exactly. While checking Kelley Blue Book is a good starting point, insurers almost always use their own internal data or valuation tools that produce lower numbers. KBB provides a range, and adjusters will typically point to the bottom end. A professional appraisal calculates a precise, market-correct value for your specific vehicle in your location, leaving no room for lowball offers.

Why does ACV matter if my car is repairable?

Your vehicle’s pre-accident ACV is the critical starting point for any diminished value claim. Before you can calculate how much value your car has lost due to its new accident history, you must first establish what it was worth right before the crash. An accurate ACV is essential for getting the full compensation you deserve, whether your car is a total loss or is being repaired.

Can I claim diminished value if the accident wasn’t my fault?

Yes, in most states you can file a diminished value claim against the at-fault driver’s insurance policy. This is known as a third-party claim. Because their driver’s negligence caused your property (your vehicle) to lose value, their insurance is responsible for making you whole. Check the laws in your specific state to confirm your rights.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your total loss appraisal today